Through our independent agency, you can compare hybrid long term care insurance quotes and illustrations from One America State Life Insurance Company. They offer both single and joint annuity and life plans to fit most situations.

Through our independent agency, you can compare hybrid long term care insurance quotes and illustrations from One America State Life Insurance Company. They offer both single and joint annuity and life plans to fit most situations.

We offer their hybrid annuity and life plans direct to consumer. Using our expertise and guidance, we can help your decide which type would be most appropriate for your long term care planning while also explaining what you can count on from your coverage in the future.

Linked long term care plans are growing in popularity and for good reason. These policies offer liquidity and leveraged benefit pools to their owners while also providing residual benefits to the policy’s beneficiaries.

One of their most attractive features however is the elimination of ongoing premiums. Like other carriers offering hybrid long term care, One America State Life has products that can be funded with a single premium or a set number of fixed deposits. Unpredictable lifetime premiums can be eliminated with their asset based long term care policies.

One America State Life Long Term Care Annuity Policies

Depending on where you live, State Life will offer one or two types of hybrid annuity plans. Both annuities offer different benefit lengths to choose from as well as guaranteed policy growth and inflation protection options.

Most of our clients have a number in mind when they contact us. For example, someone might want to know how much a $100,000 investment in a LTC annuity would generate in current and future long term care benefits.

Other times, we reverse engineer plans to find out how much premium it would take to create a desired daily benefit for a known number of years. It’s not a one size fits all approach with our agency. Still in other cases, our clients are wanting to know what their benefit pools will look like if an existing annuity is rolled over into their hybrid product.

And that’s one of the advantages of hybrid annuity accounts from One America State Life. They will accept non-qualified annuity monies on a tax free basis. This is called a 1035 tax-free exchange and can be a valuable strategy for long term care planning.

First, the 1035 exchange (annuity rollover) does not create a taxable event and second, all qualified distributions for long term care from the new annuity are not taxable either – even the gains! This would include the gains rolled over from the previous annuity.

One America State Life Hybrid Life Insurance For LTC

In some cases, a hybrid long term care life insurance plan is most beneficial for our clients. One America offers several versions of this products and in some cases life policies will provide additional leverage when compared to a hybrid annuity.

When you are shopping for asset based long term care, it is our opinion that one of the most important factors is leverage. In other words, you want to create the largest pool of money that can be used to cover long term care costs with the least amount of money invested.

Hybrid life insurance policies can be advantageous for those who are younger and in good health. The benefit pools can be larger and may require a smaller deposit when compared to some hybrid annuities.

And life insurance benefits have the advantage of being income tax free at passing. If the policy is never used for long term care purposes, then it will pay income tax free to the named beneficiaries of the policy.

One America State Life offers both hybrid life and annuity polices that our clients find attractive when planning for future long term care expenses. We can help you understand how both work and which may be of more benefit to you and your family.

Joint Hybrid Long Term Care Covering Both Spouses

If there is one segment where One America bests the competition, it is with joint long term care plans. Both their annuity and life plans can be purchased on joint lives.

Joint plans eliminate the need for a husband and wife to purchase two different policies – or try to connect their plans with a shared type of rider. Both insured spouses have access to the same pool of money at the same time with One America.

This may also provide additional leverage – especially if one spouse needs more long term care benefits than the other. Why invest $75,000 in two separate policies, when you can place $150,000 in one? With one plan, both spouses will have access to a larger pool of money if it’s needed. And both spouses can access this pool of money at the same time for long term care.

Inflation Protection For Guaranteed Policy Growth

One of the biggest concerns we hear from long term care shoppers is the cost of care. In many parts of the country, facility cost are approaching $200 a day. It does not take long for some LTC policies to be depleted at this rate.

In order to combat these high costs, One America State Life offers inflation protection options that can be purchased and added on both their life and annuity plans. The most common choice is a 5% compounding rider that will guarantee an increase in the daily benefit each year.

Benefit lengths and pools can be tailored to meet most requests. Most of our clients choose plans that will last a minimum of 5-6 years, but longer terms are available. And some policies offer a lifetime benefit pool for those who want maximum benefits that will never run out.

Policies are sold to age 80 and some medical underwriting is required for most plans. Like all things insurance, it is best to investigate and purchase coverage while you are younger and in good health. The longer you wait, the less leverage you can buy and the more difficult medical underwriting can become.

Contact Us For Quotes And Information

Hyers and Associates is a full service, independent insurance agency specializing in hybrid long term care plans. We offer hybrid insurance coverage from One America State Life and several other carriers. Contact us today to discuss your best options.

Category: Long Term Care Insurance, Retirement Planning

If you are researching hybrid long term care policies, then you may want to consider the Lincoln MoneyGuard life insurance product. In this post, we will discuss how this policy works and provide examples of the benefits it will provide now and in the future.

Addressing Long Term Care Using Hybrid Insurance Plans

Asset based planning for long term care is very popular and for good reason. These policies allow consumers to leverage their invested dollars several times over to create a tax-qualified long term care policy. All of this can be done with a single premium – or a fixed number of premiums.

Hybrid LTC plans are advantageous as they eliminate indefinite yearly premiums, future premium increases and paying tens of thousands of dollars for something the insured may never benefit from. Life insurance and annuity plans providing tax-qualified LTC benefits provide growth, access to the invested premium, and a residual death benefit for the owner’s beneficiaries.

Lincoln Financial MoneyGuard Hybrid Long Term Care

All hybrid LTC plans are built off of either an annuity or a life insurance policy. MoneyGuard is built off of a guaranteed universal life insurance chassis. Your total benefit pool for long term care will be determined by factors including: your age, gender, selected benefit period, inflation protection and deposit amount.

Policies can be funded with a one-time single premium or through installment payments of 2-10 years. All things being equal, your life insurance policy (and LTC benefit pool) will be larger if the funds are deposited over shorter amount of time or through a single premium. You can choose between 2-7 year benefit periods, but the policy will last longer than your chosen term if you are not using the full allotted long term care benefit amount each month.

Both 3% and 5% compounding inflation options are available for purchase so the policy benefits can keep up with the rising costs of health care. When inflation protection is added, policies can create a sizable future benefit pool for the insured.

MoneyGuard offers an 80% and 100% return of premium feature should the insured want/need their premiums returned. One of these two options is chosen at purchase and will affect the overall benefit pool.

Polices are available for purchase between ages 40 and 79. Applicants over age 79 will not be accepted. Spousal discounts are available – even when the other spouse does not apply or is not accepted due to poor health. MoneyGuard can only be purchased on one life however – so spouses will each need to purchase their own plan. Plans cannot be linked.

MoneyGuard Hybrid Life Insurance Examples

Let’t take a look at a hypothetical 60 year old couple in Ohio who each invests $100,000 in a 6 year MoneyGuard policy with a 3% compounding inflation rider and 80% return of premium rider.

| Lincoln MoneyGuard |

Male Age 60 |

Female Age 60 |

| One-Time Single Premium |

$100,000 |

$100,000 |

| Minimum Plan Length |

6 years |

6 years |

| Inflation Option |

3% Compounding |

3% Compounding |

| Initial Monthly Benefits |

$5,808 |

$5,264 |

| Initial Annual Benefits |

$69,700 |

$63,170 |

| Initial Total Benefits |

$450,848 |

$408,606 |

| Same Couple 10 Years Later |

Male Age 70 |

Female Age 70 |

| Monthly Benefits After 10 Years |

$7,579 |

$6,868 |

| Annual Benefits After 10 Years |

$90,943 |

$84,422 |

| Total Benefits After 10 Years |

$588,255 |

$533,138 |

| Same Couple 20 Years Later |

Male Age 80 |

Female Age 80 |

| Monthly Benefits After 20 Years |

$10,185 |

$9,231 |

| Annual Benefits After 20 Years |

$122,219 |

$110,768 |

| Total Benefits After 20 Years |

$790,565 |

$716,493 |

| Same Couple 25 Years Later |

Male Age 85 |

Female Age 85 |

| Monthly Benefits After 25 Years |

$11,807 |

$10,701 |

| Annual Benefits After 25 Years |

$141,686 |

$128,411 |

| Total Benefits After 25 Years |

$916,481 |

$830,612 |

As you can see, the 3% compounding inflation significantly increases the benefit amounts provided by this policy in the later years. After 20 years, a $100,000 premium has purchased well over $700,000 in long term care benefits for each spouse. This is 7X worth of leverage and estate protection. A 5% inflation rider would illustrate even higher numbers.

And if the policy benefits are never used, their is a residual tax-free life insurance benefit to the named beneficiaries. While this number fluctuates, it will never fall below a certain amount. In the example above, the life insurance minimum death benefit for the husband is $139,400 and for the wife is $126,339.

And what if the policy has been exhausted completely through long term care withdraws? The Lincoln MoneyGuard is unique in that it still provides a small life insurance benefit. In the example above, it is $6,970 for the husband and $6,316 for the wife.

What If I Change My Mind And Want My Investment Back?

At purchase, Lincoln National Life allows the owner to select one of two options: 80% return or premium or 100% return of premium. The LTC benefit pool will be larger when the 80% feature is selected. The entire 80% of funds are returnable once they have been deposited.

The 100% return of premium feature vests over 5 years. After year one, 80% of your premium is available penalty-free and this number increases by 4% each year until 5 years have passed. After 5 years, all invested funds can be accessed penalty-free. Loan features and other options are included that allow the owner to withdraw (and return) smaller amounts if needed. Like most life insurance policies, you have access to your deposited funds.

About Lincoln National Life Insurance Company

Any time you are investing large sums of money, you want to know that the company backing your policy is going to be around when you need them most… and that they will make good on their promises. Lincoln Financial has been offering insurance and investments since 1905 – well over 100 years.

They have an A+ rating with AM Best which is the second highest rating available. They offer life insurance, annuities, group benefits and several other lines of insurance which helps them to diversify their risk. They are a strong and reliable company.

Hyers and Associates, Inc – Insurance and Asset Planning

We are an independent insurance agency specializing in asset based hybrid long term care insurance. We work directly with the Lincoln Financial MoneyGuard product and several others. We can help you find the policy that best suits your LTC planning needs.

Category: Long Term Care Insurance, Retirement Planning

It’s an interesting question. In our experience offering hybrid long term care coverage, the answer is: It depends. Some of our clients benefit more from an annuity and others from a hybrid life insurance plan. We will discuss the pros and cons of each below.

It’s an interesting question. In our experience offering hybrid long term care coverage, the answer is: It depends. Some of our clients benefit more from an annuity and others from a hybrid life insurance plan. We will discuss the pros and cons of each below.

Some of the answer can also be found in your own personal comfort level with insurance. For better or worse, many LTC shoppers are more familiar with annuities and therefore gravitate toward these policies.

Sometimes life insurance plans have negative (and in our opinion undeserved) connotations. There are a lot of insurance “experts” who will tell you to buy term life insurance only, but that’s short-sighted.

You should keep an open mind and not approach your research with a bias. Buying hybrid long term care insurance is all about maximizing leverage and creating tax efficiencies. In some cases life insurance plans will offer more leverage on your invested dollars. These policies also provide additional tax advantages.

The Case For Hybrid Long Term Care Life Insurance

There are several different carriers offering hybrid life insurance. It’s important from the start to know there are two very different distinctions when it comes to these policies. Some life plans sold today simply offer an accelerated death benefit. In other words, you get some access to the death benefit amount if you meet certain requirements. In our opinion, these plans are more life insurance than long term care.

The second types of policies are true hybrids and are more long term care than life policy. We will be focusing on these types of coverage. They offer investment leverage, inflation protection, spousal options, and are considered qualified LTC plans. A qualified LTC plan will offer tax advantages when the policy is established and also when it pays out benefits to the owner(s).

Life Insurance Is Income Tax Free At Passing

Hybrid life insurance plans can be desirable simply because they offer tax advantages at passing. Any growth in a hybrid annuity is taxable as income at passing, but that’s not the case with life insurance. Should you invest a $100K single premium in a life plan and create a $250K death benefit, that $250K would not be taxed as income at your death. That is a big advantage life insurance policies offer over annuities.

Life insurance policies can also provide more leverage in some instances. When purchasing long term care insurance, one of your primary goals should be maximizing your benefit pool. Life insurance can accomplish this more efficiently when compared to some, not all, annuity plans. If the life policy provides a $250K pool of long term care benefits and the annuity only $230K, and all other things are equal, the hybrid life plan might be the better choice.

But insurance companies have more on the line when it comes to life insurance. If you purchase and qualify for a plan today and pass away tomorrow, then the insurance company will come out on the losing end of the transaction. Because of this, medical underwriting is more stringent with hybrid life plans when compared to most annuities. The immediate increase in your leveraged dollars requires more due diligence on the part of the insurance carrier.

In a nutshell, hybrid life insurance plans are popular for their tax-free death benefits, increased leverage and larger long term care benefit pools, but they have more medical underwriting.

The Case For A Hybrid Long Term Care Annuity

Hybrid annuities deserve a seat at the table when you’re considering asset based long term care. They also offer leveraged payouts and yearly growth opportunities through interest gains. While they don’t offer an income tax free death benefit like life insurance, they can still be purchased as tax-qualified plans.

And this is one of the significant factors that make hybrid annuity accounts more desirable than life insurance plans. Annuities will accept transfers from other annuities on a tax free basis. This is called a 1035 tax free exchange. While you can perform this same transaction with the cash value in life insurance plans, it is rare for someone to have $100K cash value in a life insurance plan that they want to transfer over to a hybrid policy.

Hybrid Annuities – Leveraging Tax-Deferred Assets

It’s not as rare for someone to have $100K in an annuity. As an agent, oftentimes I will hear that this same $100K is earmarked for long term care expenses.

It’s not as rare for someone to have $100K in an annuity. As an agent, oftentimes I will hear that this same $100K is earmarked for long term care expenses.

That’s great, you’re planning ahead. But why not leverage those dollars 2 or 3 times over and watch them grow each year? That way, if you spend your $100K, you can then spend another $100K-$200K of the insurance company’s money.

And that’s what LTC planning is all about. Protecting your assets, leveraging your dollars and spending the insurance company’s money – not yours – is paramount.

You might ask, what happens to the taxable gains in an old annuity when it’s exchanged for a hybrid annuity account? The investment growth is not taxed upon transfer (when using a proper 1035 exchange) and the growth is not taxable when the payouts are used for long term care purposes. It’s a win win.

And as we stated before, some LTC shoppers are simply going to be more comfortable with annuities. They are more of a known quantity with less moving parts and may simply provide more peace of mind. There’s nothing wrong with that. Don’t let someone put your hard earned dollars into something you are not comfortable with over the long haul.

The Case For Any Hybrid Long Term Care Insurance Plan

If you are planning for LTC with an asset based approach, then either a hybrid annuity or life insurance plan will offer meaningful estate protection. They will both serve the purpose of leveraging your invested dollars and providing a significantly larger pool of money.

And more importantly, these plans can be funded with a one-time single premium so you never have to worry about future premium increases like you would with traditional long term care policies. And most hybrid plans also offer a return of premium – or at the very least access to your investment should you need it.

Additionally some hybrid plans also offer joint coverage. In other words, both you and your spouse can be covered under one policy. With traditional long term care, that’s usually not the case. Those policies may offer a shared care rider, but you have to use your policy up first before tapping your spouse’s policy. Joint hybrid policies allow both spouses to draw from the same pool of money at the same time. Hybrid plans allow you to invest less in one policy than more in two.

Hybrid plans also accept 1035 tax free exchanges from existing insurance policies like annuities and life insurance. This can help you leverage an under-performing asset while also providing estate protection for you, your spouse and your heirs. No longer will you need to self-insure for such a potentially large out of pocket expense.

Contact Us To Compare Hybrid LTC Quotes And Illustrations

Hyers and Associates is an independent insurance agency offering LTC quotes and coverage direct from several carriers. We can help you compare plans side by side in order to find the hybrid policy that best fits your needs and goals. Contact us today for a free consultation.

Category: Annuities, Articles, Long Term Care Insurance, Retirement Planning

Recently, I was contacted by a prospective client who had been going without a Medicare supplement insurance policy for a few years. She was in good health and did not feel the urgency to purchase a plan that would help fill in the gaps of Medicare Parts A & B.

Recently, I was contacted by a prospective client who had been going without a Medicare supplement insurance policy for a few years. She was in good health and did not feel the urgency to purchase a plan that would help fill in the gaps of Medicare Parts A & B.

In the insurance industry, it is not uncommon for agents to encounter consumers who have gone without different types of insurance for any number of reasons.

Sometimes it’s the cost and other times, it’s a calculated gamble. Some may be able to go their whole lives without doing much insurance planning and be no worse for the ware.

Unfortunately, that was not the case with my client. Her good health had kept her out of the hospital for quite a while until she had a health incident that required her to visit the emergency room. Her doctors ran several tests and she was kept overnight for observation until cleared to go home the next day.

Fortunately, her visit to the emergency room was a false alarm. She had experienced no major health event, but had felt poorly enough to make sure nothing was seriously wrong. It may have been nothing more than too much caffeine in her case.

Medicare Supplement Plan & Out Of Pocket Costs

After she left the hospital the next day, she returned to her normal daily activities and felt fine… until she received the bill for her stay. Medicare covered its portion, but her out-of-pocket costs were several thousand dollars. Several thousand dollars for a one night stay and a battery of tests and exams.

Her gamble to go without Medicare supplement insurance did not pay off. She called our agency and we helped her enroll in a policy so that she would never face these kinds of bills again. If she had owned a good Medicare supplement (like a Plan F, G or N) or even a Medicare Advantage plan, her portion of the hospital bill would have been a couple of hundred dollars at most – or nothing at all.

Buying A Medicare Supplement Insurance Policy

She is now covered and has very little to worry about should she face something like this again, but it was a real eye opener. Sometimes consumers are under the false impression that Medicare pays 80% of all claims and they are only responsible for the remaining 20%.

It does not work this way in all cases as there are several gaps in Medicare that can be more or less than 20% – and in some cases they can add up quickly – even for a brief medical event.

Some gaps in Medicare require the uninsured to cover a certain amount per day. In some cases, these per day costs can be over $500-$600. After only a few days, this can add up to a very large bill. Having some type of supplemental coverage can help to save the insured thousands of dollars if and when a large medical bill is encountered.

Medicare Supplements & Medical Underwriting

The other part of her story that is worth telling is that she was able to buy a Medicare supplement plan even after her health event. That’s because she was still in good health and her stay was a false alarm. If her event was more serious, then she may have not been able to purchase a Medicare supplement from us at all.

If you are not in your open enrollment window (age 65) or experiencing a qualifying event (losing group coverage for instance) then you will very likely have to undergo medical underwriting before you can buy a plan. And if you’re in poor health, then you can be turned down.

It’s important to remember that the times you want insurance the most, it may be hard to get it. Some policies have waiting periods (like dental insurance) and others require medical underwriting (long term care) that can cause an applicant to be turned down.

In other words, you must plan ahead. We have a saying in the insurance industry that really states the obvious, “The best kind of insurance you have is the kind that you don’t use.” No one wants a claim on their home, car, health or finances – but they happen. You buy insurance for the rainy day that you may or may not face down the road. To be sure, if you really need insurance, then it may already be too late.

Insurance: Planning Ahead For The Unknown

Hyers and Associates is an independent insurance agency specializing in Medicare supplement insurance, Medicare Advantage plans, Prescription Part D policies, long term care insurance and annuities.

Contact us today to learn more about the insurance plans that can best fill the gaps in your long term plans.

Compare Medigap Quotes Today →

Category: Medicare Supplements, Retirement Planning

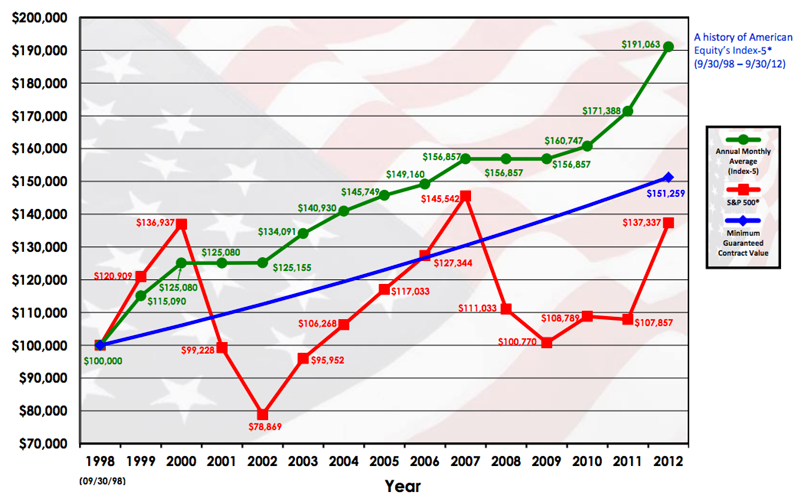

Understanding monthly point to point annuity with cap accounts is very important if you are a current or potential indexed annuity investor. Typically, these accounts offer some of the highest potential for yearly returns when markets steadily trend upward.

This post is the second in our ongoing series discussing indexed annuity sub-accounts. Our first was an explanation of the yearly point to point (PtP) account. The monthly version works a bit differently, but in the right market environment, it can credit significant returns.

Indexed Annuity Investment Sub-accounts

Hopefully, you are well read on the pros and cons of indexed annuity investing. We are taking it a step further here and describing how a point to point sub-account credits interest to indexed annuities. (See Chart Below)

Almost all indexed accounts offer the PtP option. And some offer it for different market indexes like the S&P 500, NASDAQ or Dow Jones – all within the same annuity. The PtP option (like most investments) performs best when the market is climbing steadily with few significant declines.

Explaining The Monthly Point To Point Annuity Account

It’s important to note that not all PtP accounts work in the same manner, but for the purposes of this article, we will explain the most common type and its yearly interest crediting method.

It’s important to note that not all PtP accounts work in the same manner, but for the purposes of this article, we will explain the most common type and its yearly interest crediting method.

First, you must understand that the PtP is almost always a yearly account. No interest is credited until your 12 month term has been reached. Oftentimes, consumers see the word monthly and think the account will credit interest each month. This is not the case.

The monthly point to point annuity account credits interest yearly based on the performance of the chosen index – usually the S&P 500. The yearly interest credit is calculated by adding the monthly gains (subject to cap) and subtracting the monthly losses (no cap) each month – usually over a twelve month time period. This twelve month time period will not necessarily track the calendar year.

How A Monthly Cap Affects Your Indexed Annuity Gains

Not all annuity sub-accounts have a monthly cap, but the point to point account almost always does. If the monthly gains in the S&P 500 are the gas that power your returns, then the monthly cap is the brake. An annuity cap is a very important number and investors need to work with an agency like ours to find the best one.

It’s as simple as this: The lower the cap, the lower your potential for gains. The cap is not your friend; it’s the mechanism insurance companies use to hedge against losses and remain profitable so that your money stays safe & insured.

Monthly Point To Point Annuity Example

The easiest way to explain how interest is calculated and credited to your annuity is by a hypothetical example. Most of 2013 was a very good year for investing in the overall markets. The market went up most months, there was little volatility, and the bad months weren’t too bad in comparison to some years in the past.

2013 S&P 500 Annuity Point To Point Performance Chart

| Month |

S&P 500 Return |

Annuity Cap |

Cap Applies? |

Annuity Gains |

| Jan |

5.04% |

2.50% |

Yes |

2.50% |

| Feb |

1.11% |

2.50% |

No |

1.11% |

| Mar |

3.60% |

2.50% |

Yes |

2.50% |

| Apr |

1.81% |

2.50% |

No |

1.81% |

| May |

2.08% |

2.50% |

No |

2.08% |

| Jun |

-1.50% |

2.50% |

No |

-1.50% |

| Jul |

4.95% |

2.50% |

Yes |

2.50% |

| Aug |

-3.13% |

2.50% |

No |

-3.13% |

| Sep |

2.97% |

2.50% |

Yes |

2.50% |

| Oct |

4.46% |

2.50% |

Yes |

2.50% |

| Nov |

2.80% |

2.50% |

Yes |

2.50% |

| Dec |

2.36% |

2.50% |

No |

2.36% |

| Total |

26.55% |

N/A |

N/A |

17.73% |

So what do the numbers in the chart above mean? In a nutshell, the S&P 500 gained 26.55% (excluding dividends) in 2013 – and an indexed monthly point to point annuity with a 2.50% cap would have returned 17.73% during that same time period. Are these gains realistic? In a word yes, but of course 2013 was a good year in the market and was not the norm over the last decade.

As with all insured indexed annuities, you are sacrificing some gains for safety, stability and peace of mind. You would not expect returns of 17% on a regular basis, but it is comforting to know they are possible and that you will never experience market losses of any kind – ever.

Is There A Downside Cap To My Indexed Annuity Gains?

Yes, you can never go below zero – no matter how far the market tumbles. One bad month can erase all of your monthly gains for your 12 month term, but your account will not decrease in value overall and your gains from prior years are locked in.

In other words, you can have a year with no gains when investing in a monthly point to point annuity, but not a year where your account loses money. Your premium bonus and gains from prior years are locked in and not subject to market downturns.

You can see in the chart above that there are no downside caps for months where the S&P 500 turned negative. The worst case scenario is that you could be having a good year, but a big market correction could wipe out all of your paper gains from the first 11 months. In this instance, your annuity would not credit interest, but even if the market was down overall, your annuity would not lose value.

Contact Us For Annuity Quotes And Information

Hyers and Associates Inc. is a full service insurance agency specializing in indexed annuity accounts. We can help you compare the caps, bonuses, terms and all other details of the indexed annuities that are most likely to offer the best performance.

Category: Annuities, Articles, Retirement Planning

In response to market demand, several insurance companies are offering annuity accounts with a guaranteed death benefit rider. These new riders increase the contract value each year by a guaranteed interest rate.

The annuity death benefit proceeds will be passed on to the insured’s beneficiary(s) in a lump sum – or over the course of a predetermined number of years. Those who are looking to lock-in gains and transfer wealth might consider an annuity death benefit rider.

What Does An Annuity Death Benefit Rider Guarantee?

These riders simply guarantee a yearly increase in the annuity death benefit amount each year for a certain time period.

These riders simply guarantee a yearly increase in the annuity death benefit amount each year for a certain time period.

A common rider would increase the account value each year by 5% for a set number of years (usually ten).

Some companies allow the insured to re-up the rider for another ten years, but most contracts stop rolling up once the annuity owner turns age 85. Each policy is a little different.

The death benefit rider will not change once it has been added to the contract. The annual roll-up will not increase or decrease for the ten year period. The cost (if there is one) stays the same as well. After the ten year term, the annuity owner can decide to re-up once the new rates are established.

How Are The Annuity Benefits/Proceeds Accessed?

Upon the death of the insured/annuitant, the insurance company pays the contract beneficiary(s) the death benefit amount either in a lump sum or over a set number of years. Usually the minimum number of years needed to access the total benefit is 5 years.

In some cases, the annuity beneficiaries will have a choice. They can take a smaller sum all at once – or a larger sum over 5 years. Annuity owners who are looking to transfer wealth over a period of time might deliberately establish a 5 year payout for the next generation. This can be an advantageous strategy with accounts that have not yet been taxed – like IRA’s.

If the annuity owner passes away before the ten year term has been completed, then the death benefit would only be calculated for the time the contract was in force – not the entire ten year term.

What Is the Cost For An Annuity Death Benefit?

These riders usually have an annual cost to the contract itself, but this cost does not lower the amount payable at death. Depending on the insurance company and the rider chosen, an average annual cost for a death benefit rider would be in the .70% – 1.10% range.

The annual cost means there are two accounts at work. The first is the walk-away value of the contract. The walk-away value is the amount payable to the insured if s/he surrenders the contract for some reason. The annuity death benefit rider will decrease the walk-away/surrender value each year should the owner cash-in or transfer the annuity.

The second value is the death benefit amount. This value compounds each year and is payable at death. Again, some annuities will offer this value in a lump sum while other accounts will require a 5 year payout.

The two values (walk-away & death benefit) will almost always be different. It is likely that the death benefit amount would be larger in the long run because there are no market risks, fluctuating interest rates, or annual costs to stunt its growth.

Annuity Income Riders With Death Benefits

In some cases, annuity death benefit riders are packaged with an income rider. This offers annuity owners more flexibility as they can access the death benefit value (if needed) by creating a lifetime income stream.

In many cases, the lifetime income stream might be the primary reason the rider was purchased. The increasing death benefit is a desirable feature, but guaranteed lifetime income during retirement might be the primary goal for some retirees.

This acknowledges the fact that annuities are not the most efficient investment for wealth transfer; that vehicle is life insurance. Life insurance is far and away the most efficient product for creating and transferring wealth on a tax-free basis. Readers can learn more about the use of life insurance for wealth transfer here.

Contact Us For Annuity Quotes

Fixed and indexed annuities offering an increasing death benefit can be a valuable feature for those looking to guarantee yearly gains, establish a lifetime income stream or pass an existing tax-deferred asset to the next generation.

At Hyers and Associates, we recognize that one size does not fit all when it comes to insurance and investment planning. Our independence allows us to help our clients find the most suitable products that best fit their long term needs and goals.

Category: Annuities, Articles, Retirement Planning

Each year the Centers for Medicare & Medicaid Services (CMS) make changes to Original Medicare that affect all Medicare supplement insurance polices – both old and new. We highlight those changes below.

Purchasing a Medicare supplement insurance policy can be a stressful endeavor. Using our independent insurance brokerage and the information below, you can take the guesswork out of the coverage that will best fit your needs and budget.

Like most years, the changes to Medicare are subtle and incremental. The Part A deductible has increased slightly while the Part B deductible has stayed the same. The chart below highlights the differences between 2013 and 2014.

2014 Medicare Part A and Part B Deductibles

| Medicare Feature |

2013 Amount |

2014 Amount |

$$ Increase |

| Medicare Part B Premiums (for most) |

$104.90 |

$104.90 |

$0 |

| Part A Deductible (Inpatient Hospital) |

$1,184 |

$1,216 |

$32 |

| Part B Deductible (Physician’s Services) |

$147 |

$147 |

$0 |

| Hospital Coinsurance Days 61-90 |

$296 |

$304 |

$8 |

| Hospital Coinsurance Days 91-150 |

$592 |

$608 |

$16 |

| Skilled Nursing Facility Coinsurance |

$148 |

$152 |

$4 |

| High Deductible Plan F |

$2,110 |

$2,140 |

$30 |

The good news is there are no significant changes to Medicare for 2014. Sometimes there are fears that CMS will shift more costs toward seniors, but that is not the case for 2014. This simply means that Original Medicare Parts A & B (when coupled with a good supplemental policy) will cover most if not all Medicare approved out-of-pocket costs.

Medicare Insurance Highlights

Since the changes to Medicare are minimal year over year, there is little cause for concern. Most seniors will be happy to see that their Medicare Part B premiums have not increased. This news is welcome relief for those on a fixed income.

High income earners who are subject to the Income Related Monthly Adjustment Amounts (IRMAA) will continue to pay higher premiums – just as before. There will be no increases to the IRMAA numbers for 2014 and they will still be assessed on a sliding income scale.

Plan G Medicare Supplement Insurance Changes

It is also important to note that the Part B deductible has not changed year over year. In our opinion, this continues to make Plan G a very good choice for Medicare supplement insurance. There are two reasons for this:

- Plan G rates tend to be much lower than Plan F – usually offering annual savings when factoring in the $147 Part B deductible amount

- Plan G is NOT a guaranteed issue plan. This means there are fewer enrollees and smaller rate increases when compared to Plan F

Consumers in good health or who are new to Medicare should continue to ask about Plan G in order to save money on their Medicare supplement insurance premiums.

High Deductible Plan F 2014 Deductible Amount

HD Plan F is a popular plan for those who want a low-priced Medicare supplement policy, but are comfortable with a deductible. As indicated in the chart above, the deductible has only increased by $30 year over year.

Unlike Medicare Advantage plans, High Deductible Plan F has no network restrictions – seniors can see any doctor or hospital that accepts Medicare. Additionally, there is usually less out-of-pocket exposure with HD Plan F when compared to most Medicare Advantage plans.

In Summary

The changes to Medicare were measured and consumer friendly. These adjustments continue to make Plan G and High Deductible Plan F good choices for 2014 Medicare supplement insurance.

If you are in need of assistance with Medicare Supplement, Advantage, or Part D Drug insurance – please contact our agency and we will walk you through your options online, over the phone, and where possible in person.

Category: Medicare Supplements, Retirement Planning

If you own or are considering investing in fixed-indexed annuities, it is important to understand how a point to point annuity sub-account works. In this post, we will discuss how these accounts operate and what investors can expect from them.

Considered the most conservative of most indexed annuity investment options, point-to-point accounts are the least complicated. There are no unusual formulas or difficult calculations to understand. Any money invested in a point to point account will have a beginning and end point that is used to calculate an interest payment.

Indexed Annuity Point To Point Annuity Accounts

Typically, indexed annuities track a market index like the S&P 500, DOW Jones or NASDAQ. Should the tracked index rise, the insurance carrier will take the percentage difference between the beginning and end points in order to calculate an interest credit to the annuity.

For example: Let’s take $100,000 invested in a one year point-to-point account with no cap that tracks the S&P 500. If the value of the S&P 500 was 1500 when you funded your annuity and 1650 one year later, then that would be an increase of 150 points. This translates to a 10% increase.

Assuming no other variables, the point to point annuity would credit 10% interest growth and the account would be worth $110,000 one year later. The account would then reset for a new one year term. If in year two, the S&P 500 dropped back to 1500 from 1650, then no interest would be credited and the account would stay at $110,000 and reset using 1500 as the new starting point for the third year.

Annuity Caps, Spreads And Participation Rates

Other than the beginning and end points, the other factors to consider are any caps, spreads or participation rates that are applied after the term of the account has ended. Most (not all) indexed annuities will have some kind of ceiling or limiting factor on the amount of interest growth that can be credited to the account after the term is over.

If the insurance company had a 6% cap in the one year hypothetical example above, then the account would only have credited 6% in as that would have been the ceiling for growth. After year one, the account would be worth $106,000 (not $110,00) and everything else would remain the same. In other words, you would have only been credited 6% – not the 10% actual growth in the index itself due to the yearly cap.

Other insurance companies will use participation rates or spreads to hedge their risk when issuing a fixed-indexed annuity. Using the same example above with a 50% participation rate and no cap, the owner would only be credited 50%. The growth in the index was 10%, but 50% of that growth (or 5%) was the maximum stipulated in the contract.

On the other hand, a spread a could be 1.5% in a typical indexed annuity. This means that 1.5% of the 10% growth is not credited to the account. Using the example above, the owner would be credited with 8.5% growth (10% – 1.5% spread = 8.5% interest rate) at then end of one year.

Annuity investors should know that most insurance companies will use either a spread, cap or participation rate to calculate yearly interest, but not all three. And these numbers will be known at the beginning of the term – they are not a secret. While they can change from year to year, they are always stated at the beginning of the point to point term.

Annuity Indexing Options, Term Length & Interest

Most annuities offering a point to point sub-account calculate interest over a one year period of time, but there are some accounts that credit interest after a two year (or longer) term. Some can be as long as five years.

The advantage of point to point annuity accounts with longer terms will generally be higher caps, spreads and participation rates. The higher these numbers, the more potential interest growth for the investor.

Most fixed-indexed annuities will track the S&P 500, but there are many that track different indexes or a combination of indexes. Some annuities track the major indexes here in the U.S. and others will offer foreign indexes as an option. More indexing options will provide more opportunity for growth should one area of the economy be performing better than another.

Understanding Fixed-Indexed Annuity Accounts

It is important to remember that unlike variable annuities, mutual funds and stocks and bonds – fixed indexed accounts are safe and insured. Any interest gained in an indexed annuity can never be lost due to market fluctuations or corrections. You never own any stocks in the index – indexed annuities are not variable accounts and cannot lose money due to market fluctuations.

Annuity accounts may not make you fabulously wealthy. They are more conservative in nature and are designed to offer higher potential interest than a C.D. (or fixed annuity) without any additional risk to your principal. While interest returns can be in the double digits in very good years, it would be unreasonable to expect an indexed annuity to average double digit returns for the overall term of the contract.

Should you be considering investing in a point to point annuity, contact us and we can help you find the account that best suits your needs and goals.

Category: Annuities, Articles, Retirement Planning

Tags: point to point annuity, point to point indexed annuity

There are several types of retirement annuity accounts offered from various insurance companies. The one that will work best for you will depend on your short and long term financial goals.

There are several types of retirement annuity accounts offered from various insurance companies. The one that will work best for you will depend on your short and long term financial goals.

If you are closer to or at retirement, then a single premium immediate annuity account might be best. If you are saving toward retirement, then a deferred annuity with an income rider might be more appropriate.

Simply put, one size and type of annuity does not fit all situations. At Hyers and Associates, we work with a wide array of insurance companies in order to find the highest yielding annuities that best fit our client’s needs and goals.

Tax Deferred Retirement Annuity Accounts

Tax deferred annuities are best for those who are saving toward retirement and wish to accumulate funds that can later be used to generate a guaranteed income stream. Deferred annuity accounts accept both pre and post tax monies – either way the account will not be subject to income taxes until distributions are taken.

Non-qualified annuities (post-tax) are a common type of retirement annuity used for savings and accumulation. These accounts take advantage of compound growth and there are no requirements for when distributions must be taken. Owners can defer earnings and grow their retirement nest eggs for as long or as little as needed.

Fort those who have maxed out contributions to their retirement accounts, a non-qualified tax deferred retirement annuity can be a valuable investment. Contribution amounts are limitless, all funds compound on a tax-deferred basis and there are no distribution requirements.

Depending on your risk tolerance, a fixed, equity indexed, or variable annuity can be used to save toward retirement. In order to balance risk, some investors will use more than one type of account.

Lifetime Income With Certain Annuity Riders

We have written extensively about annuity income riders as these products offer a valuable way to grow your investment in order to later create a lifetime stream of income.

We have written extensively about annuity income riders as these products offer a valuable way to grow your investment in order to later create a lifetime stream of income.

Several insurance companies offer income riders and they can be attached to fixed, fixed-indexed and variable annuities depending on your risk tolerance.

Income riders offer a safe and reliable way to save toward retirement. In a nutshell, income riders create a sub-account that is guaranteed to increase by a known percentage each year (say 7%). The sub-account can be activated at desired future time to create a lifetime income stream.

The sub-account is typically not available for full withdrawal, rather it is used to create lifetime income for the owners. Theses riders usually have a yearly cost (say .70) to the walk-away value of the contract, but those costs are not deducted from the income sub-account.

In this way, there are always two values at work; the walk-away amount and the sub-account value. We can illustrate both for our clients so they can better understand what to expect from these types of retirement annuities.

It is also important to note that some lifetime income riders are also offering leveraged protection for long term care expenses, inflation protection, and in other cases full access to the sub-account value if it’s taken over a period of years. The bottom line is these riders offer known and dependable future lifetime income for their owners.

Learn more by visiting these pages:

https://www.ohioinsureplan.com/annuities/annuity-income-riders/

https://www.ohioinsureplan.com/annuities/deferred-income-annuity/

Immediate Income Annuities During Retirement

If you are at or very near retirement, then an immediate annuity might work best to create retirement income. Many consumers use these accounts to generate systematic payments for a set number of years – if not a lifetime.

The acronym used by insurance professionals is SPIA: Single Premium Immediate Annuity. SPIA accounts are usually funded with a lump sum investment in order to create a desired stream of income for one or two lives.

There are several ways to structure an immediate annuity to best fit the needs of the investor. Payments can be made for a set number of years (period certain), a lifetime, or a lifetime with period certain. Invested funds will earn interest before distribution and in some cases payments can be adjusted upwards for inflation each year.

We work with several SPIA providers in order to find the best payouts from the most highly rated insurance companies.

Contact Us For Annuity Information

Hyers and Associates is a full service, independent annuity agency. We offer fixed, indexed, immediate and income annuity riders from many, many carriers. We can help you compare and understand the policy(s) that may best fit your retirement needs.

Category: Annuities, Articles, Retirement Planning

Tags: retirement annuities, retirement annuity

We have written extensively about the benefits and limitations of annuity income riders. There is a lot to learn about these accounts and we do our best to educate consumers online, over the phone and in person.

The purpose of this article is to discuss some of the innovations with newer income riders. Not all are created equal, but we help tailor our recommendations to what best fits your short and long term investing goals.

Summary Of Traditional Annuity Income Riders

First, a little background: Annuity income riders are usually separate riders purchased along with a fixed or indexed annuity account. Some are free while others have an annual cost deducted from the walk-away value of the contract.

An income rider creates a separate account (sometimes referred to as a ghost account) that increases each year at a predetermined rate – say 7%. After some years of deferral, the income account is activated and it creates a lifetime stream of income for the annuity owner(s).

In other words, there are two accounts with two separate values at work. One that the owner (or beneficiary) can withdraw lump sum and the other that is used to create a lifetime stream of income. If you would like more information about how these account work, please click here.

Leveraging Income For Long Term Care Expenses

Some new annuity income riders will leverage their payouts in order to account for long term care expenses. Should the income rider be activated and the insured be confined to a nursing home, then some contracts will triple the systematic payout for a maximum of 60 months.

There is no medical underwriting necessary for this feature; it is just an added benefit to help account for LTC costs. After 60 months, the income rider would revert back to its normal payment for the life of the insured(s) even if the annuity and/or ghost account was depleted.

Unfortunately, most riders that allow for a leveraged long term care payouts will only cover care in a nursing home environment. In the future, perhaps some riders will also leverage for home health care and assisted living.

It should be noted that there are traditional and hybrid policies that are more geared toward solely accounting for long term care costs. They will offer more flexibility and features than the income riders mentioned above.

Turning Income Off And Retaining Proceeds

One of the benefits of an annuity income rider is flexibility. These riders can be placed in deferral for several years in order to maximize future income. Once the income has been turned on, many riders allow the owner to turn it off and then back on later as needed.

In some cases, the accumulated income not withdrawn while the rider has been turned off can be accessed lump sum at a later date. If for example an activated income rider paying $10,000 a year was turned off for three years – the owner could withdraw $30,000 in a lump sum when the rider was reactivated.

This can be helpful for those who need the flexibility and accessibility of large sums of money at different times. This could be due to tax implications or inherited wealth or any other number of reasons. Most importantly, it is not a use it or lose it proposition for the annuity owner if income is turned off.

Adjusting Annuity Income For Inflation

Depending on your future income needs, it may be necessary for the systematic payments to increase year over year. Insurance carriers have accounted for this need in different ways so that your income can ratchet up over time.

Some riders will simply start at a lower rate and then increase by 3% each year. In other cases, income can grow based on the performance of the annuity itself. And others will track a known inflation indicator like the CPI and adjust future income based on its movements.

Constant and steady income may be right for some while income that adjusts for inflation might be better for others. There is always a trade-off when introducing new features to an income rider, but the important factor is that annuity owners have a choice.

Contact Us For More Information

Hyers and Associates is a full-service, independent provider of fixed and indexed annuities. We do the shopping for you. It does not affect your returns in any way to use our agency for your annuity transaction.

We will help you compare the various annuity riders and options available in your state of residence so that you may invest in the account that best suits your present and future needs.

Category: Annuities, Articles, Retirement Planning

If you are in the workforce beyond age 65 and covered by your employer’s group health insurance coverage, it is important to be aware of your Medicare insurance options. There are a few common penalties (both monetary and temporal) that you might face should you miss your enrollment deadlines.

Penalties and Medicare enrollment delays can easily be avoided so long as you are proactive. It is wise to talk with your human resources manager when you turn 65. You will want to ask specifically about your group health insurance eligibility. You can also talk with an insurance agent who is knowledgeable about group plans and Medicare eligibility.

If you are still not satisfied, then you might also reach out to your local social security office. Oftentimes the representative there can provide valuable advice. Additionally, it is a good idea to read about your options online and at Medicare.gov.

Employer Group Size – Twenty Is The Magic Number

As it relates to Medicare decisions, the most important factor is the size of your company in terms of employees when you turn 65. If your group is under twenty employees, then you will need to enroll in Medicare Parts A and B.

You can no longer stay on your group health insurance even if it goes undetected. Once your group insurance carrier figures out that you are Medicare eligible and that your group does not meet the 20 employee requirement, then the insurance company will no longer pay benefits and can recoup costs for benefits already provided.

In a nutshell, if you are within 3 months of your 65th birthday and still plan on working at a company with fewer than 20 employees, then you should enroll in Medicare Parts A and B and you should also consider Medicare supplemental coverages.

Employer Groups With More Than Twenty Employees

If you are soon to be 65 and working for a group with more than 20 employees that provides group health insurance, then you can safely maintain this coverage if you wish.

Some will choose this option in order to avoid paying Medicare Part B premiums. Medicare Part B premiums are means tested, so those in higher income brackets will pay more for this coverage as well as Part D prescription drug plans.

If you are happy with your group health plan, then you can delay enrollment into Medicare Part B and stay on your group health plan while also avoiding the cost of Medicare Part B, supplemental, and Part D premiums.

You may choose to enroll in Medicare Part B at age 65 even if you are still under your large group health plan, but it is important to know that you are not forced into Medicare when you continue working for a large employer group that offers group health insurance.

The COBRA Health Insurance Conundrum

One simple piece of advice is this: Don’t take COBRA health benefits when you retire and are over age 65. COBRA usually lasts 18 months, but by the time these benefits expire, then you will have missed your individual deadline to enroll in Medicare Part B.

If you are over 65, then there are very few reasons, if any, to stay on COBRA for an extended period of time. Your Medicare Part B enrollment window begins when you leave your job, not when your COBRA benefits end.

If you have waited beyond your 6 month Medicare open enrollment window (after separating from employment) to enroll in Part B, then you will be subjected to a 10% Part B late enrollment penalty when you do try to enroll with the government. The 10% penalty will be for your lifetime. And you will have a new waiting period before you can enroll in Part B. It’s a double whammy and it’s not good.

By avoiding COBRA and talking with your local social security office upon separation from employment or turning age 65, you can be sure that you are enrolling in Medicare at the appropriate time. You will also want to use this guaranteed issue period to find the supplemental coverage that you feel best fits your Medicare needs.

What About Medicare Supplemental Coverage?

Medicare covers roughly 80% of most health bills. This is why most seniors purchase a Medicare supplement, Medicare Advantage, and/or Part D plan. These coverages can help pick up some or all of what is not covered by Medicare.

Supplemental plans are sold by insurance agents (like us) and are private policies whereas Medicare Parts A and B are federally sponsored public plans. Supplemental plans can also have late enrollment penalties and delays. And in some cases, you may not be able to purchase any supplement if you have waited beyond your open enrollment or guaranteed issue period of time.

Medicare Parts A and B are only the first half of the Medicare puzzle. Once you have enrolled in Original Medicare with the government, you will want to use your open enrollment window to explore your supplemental plan options. It is wise to speak with an independent agency (like us) to decide which plan(s) best fit your needs and budget.

Medicare Is A Little Complicated

There is no doubt that if you are new to Medicare, the enrollment process can be somewhat intimidating. Above all else, it is most important to enroll at the appropriate time. Missing your open enrollment window will add a premium penalty and delay your eligibility.

If you are unsure, it is wise to lean on the experts who work with senior insurance programs everyday. Talk to a chosen insurance agent, human resources manager and/or a Medicare representative over the phone or in person.

Contact Us

Hyers and Associates, Inc. is a full service independent insurance agency specializing in health coverage for seniors. Contact us today to learn more about your options.

Category: Medicare Advantage, Medicare Supplements, Retirement Planning

It’s almost a new year which means changes to the Medicare Part A and B deductible amounts for 2012 are here. The Part A deductible is increasing by a nominal amount, but the Part B deductible is decreasing.

You read that correctly, the Part B deductible is going down which means that some Medicare supplement insurance plans will become more attractive based based on their monthly premiums. We’ll address that benefit later in this post.

Medicare Part A and Part B Deductible And Coinsurance Increases and Decreases For 2012:

| Medicare Feature |

2011 Amount |

2012 Amount |

Percent Change |

| Part A Deductible (Inpatient Hospital) |

$1,132 |

$1,156 |

2.12% |

| Part B Deductible (Physician’s Services & Supplies) |

$162 |

$140 |

(15.71%) |

| Hospital Coinsurance Days 61-90 |

$283 |

$289 |

2.21% |

| Hospital Coinsurance Days 91-150 (lifetime reserve) |

$566 |

$578 |

2.21% |

| Skilled Nursing Facility Coinsurance |

$141.50 |

$144.50 |

2.21% |

Part B Deductible Decrease for 2012 and Plan G Supplement Premiums

The most significant change to the Medicare deductibles for 2012 is the somewhat dramatic decrease for the Part B deductible out-of-pocket. This lower amount makes plans that do not already cover the Part B deductible more attractive. Typically the difference in premiums and coverage will dictate your purchase.

One such Medigap option available for purchase is Plan G. Plan G covers everything that Plan F does except for the Part B deductible. If Plan G happened to be $300 less (as can be the case) per year than Plan F and Plan F only covers $140 more in costs, then Plan G is a wise choice. Plan N might also fall into this category if you live in a state (Ohio for instance) that does not allow for Part B Excess charges.

High Deductible Plan F Changes

The Medicare supplement Plan F high deductible amount is also increasing in 2012. The deductible was $2,000 in 2011 and will be $2,070 for 2012. This is not too significant of a change if you already own this plan or if you are considering purchasing it.

The premiums associated with High Deductible Plan F are usually very inexpensive and can be a good choice if you are comfortable with a little more out-of-pocket exposure. It is important to remember if you wish later to enroll in a more comprehensive Medigap plan, some medical underwriting may be required with almost all insurance companies.

If you own High Deductible Plan J (no longer sold from any company by law) then your deductible will also be increasing to $2,070 f0r 2012.

Medicare Part B Premiums From The Government

Medicare Part B monthly premiums will be $99.90 for most beneficiaries in 2011. This is slightly more for those who have been paying $96.40, but slightly less than was originally projected by the Centers of Medicare and Medicaid services earlier in the year.

Medicare Part B premiums are means adjusted however and will be higher if you reach certain income levels. For individuals the percentage increases start with an adjusted gross income of $85,000 and for those who file jointly the increase begins at $170,000 of AGI.

Prescription Part D premiums will also be higher if you are earning the above listed amounts or higher. If you are turning age 65 and still employed with access to employer group coverage, it is wise to weigh all of your options before automatically signing up for Medicare Part B. Depending on the size of your group, it may be necessary to enroll in Part B however.

Request Medicare Insurance Information and Quotes

Hyers and Associates is a full service, independent agency specializing in Medicare supplement insurance.

We work in in several states and help consumers enroll in the Medigap and Part D plan of their choice direct – at no additional cost.

Category: Medicare Supplements, Retirement Planning

The Pension Protection Act of 2006 became law in January of 2010. The law offers several provisions to incentivize the purchase of long term care insurance coverage.

The Pension Protection Act of 2006 became law in January of 2010. The law offers several provisions to incentivize the purchase of long term care insurance coverage.

One component of this law allows you to use taxable annuity dollars to purchase a long term care insurance policy.

This provision is useful if you have significant tax-deferred accumulation in a non-qualified annuity. You can use those dollars to purchase long term care coverage on a tax-deferred basis.

LTC Insurance And The Pension Protection Act

First, it is important to know that Medicare and/or supplemental policies do not pay for extended LTC stays. And government run Medicaid will only cover these costs once you have spent down most of your estate.

The Pension Protection Act allows you to use annuity (and life insurance) polices as a tax efficient means to purchase LTC insurance. There are a couple of ways to implement this strategy and it will mostly depend on whether you own an existing non-qualified annuity account.

Tax Advantages Of Periodic Annuity Payments

A non-qualified annuity is one where the invested principal has already been taxed.

The interest (or investment) gains within the annuity have grown on a tax-deferred basis and are only subject to income tax when they are withdrawn.

So long as the account has not been annuitized, then any money that is withdrawn from the annuity would be taxable until all of the growth has first been distributed. Put another way, the gains come out first – not the principal.

However, the Pension Protect Act allows you to withdraw your investment gains tax free in order to purchase long term care insurance. If you invested $100,000 in an annuity and the policy has grown to $120,000 – then you could withdraw the $20,000 on a tax free basis to pay for a long term care insurance policy.

This is a valuable benefit for those who have invested in an annuity account and wish to protect their estate by purchasing long term care insurance. It is important to note however that the new law does not allow for tax free withdrawals from qualified (IRA, 401k) annuities to purchase LTC insurance.

Tax Free 1035 Exchange To A Hybrid Annuity

Hybrid annuity policies that include a provision for long term care also benefit from the new law. If you own an existing non-qualified annuity with any tax deferred growth, then you can execute a 1035 tax-free exchange to a new hybrid annuity account.

This exchange will protect the gains in your old, surrendered annuity from income taxes on any level. Your invested dollars will be leveraged two to three times over in the hybrid annuity for long term care benefits. Additionally, any tax-deferred dollars paid out for qualifying care will be tax free.

Hybrid annuity policies are quickly growing in popularity with those who want to maintain control of their assets, but who also want to leverage their invested dollars in the event that extended care is ever needed. Global Atlantic and One America/State Life are two companies that are competitive in the hybrid annuity market place.

These plans are also popular as they require less underwriting than traditional LTC coverage. They are easier to qualify for if you have any preexisting conditions or health concerns.

What If I Don’t Already Own An Annuity?

If you don’t already own a deferred non-qualified annuity, then you can still purchase one. You could invest a lump sum in a deferred annuity and withdraw only the interest, on a tax free basis, to pay for a long term care policy. Or you could pay for a long term care policy using an annuitized single premium policy.

If you wish to to have LTCi sooner than later and you don’t want to risk the insurance company declining your application because of health issues, then an immediate, annuitized plan might work best.

Deferred annuities are favorable when the owner can wait several months to a year for their interest to accumulate before purchasing the LTC insurance plan.

Using An Immediate Annuity For Systematic Payments

An immediate annuity is exactly that; one that begins payouts to the owners almost immediately – usually after only one month, but no longer than one year after the deposit has been made. Thus, an immediate annuity makes systematic payouts of principal and interest each payment cycle.

The principal would not be taxed under any circumstances, but the interest can be taken tax-free so long as it’s used to fund a long term care policy. The payouts can be setup for a set number of years or even a lifetime, but in all cases this method of systematic payments is known as an annuitization.

There are several ways to use an immediate annuity. One strategy is to invest in one that will make systematic equal payments for 10 years and then use those dollars (tax free) to purchase a 10 year paid-up long term care policy.

The annuity payment stream could also be setup for a lifetime. In most cases however, there is no guarantee that your LTC insurance premiums will not increase sometime in the future. This is why some consumers purchase a 10 year paid-up policy.

At any rate, your insurance broker (us) can tell you exactly how much you need to invest in any type of annuity to cover the premiums for your chosen long term care coverage.

Qualified Long Term Care Partnership Plans

People are living longer and medical inflation is extremely high. Governments on all levels are running huge deficits and Medicaid liabilities are a significant reason for their indebtedness.

In response, many states have recently passed laws establishing partnership qualified long term care plans that further add financial incentives to purchase extended care insurance. In a nutshell, many state governments will allow you to protect your estate up to an equal amount of purchased long term care insurance.

That is to say, if you purchase a policy that provides $250,000 in benefits and you end up using the entire amount, then your state cannot legally force you to spend down an additional $250,000 from your estate before Medicaid qualification would be available.

Regardless of the amount of money spent by your insurance policy, Medicaid, and/or your estate – you will have protected at least $250,000 that can be passed on to your beneficiaries.

Request Quotes And Information

In summary, federal and state governments are providing much needed tax and planning incentives for those who wish to purchase long term care insurance.

Whether you are using deferred or immediate annuity policies, hybrid accounts, or partnership plans – there are several tax advantaged strategies designed to protect your family and your estate from the exorbitant costs associated with extended care.

Hyers and Associates, Inc is an independent insurance agency specializing in annuity accounts and long term care insurance plans.

Category: Annuities, Articles, Long Term Care Insurance, Retirement Planning

Planning for retirement income is an often overlooked but necessary piece of any financial plan. Some retirees rely on stocks and bonds, others opt for annuity accounts, and many use a mixture of both in order to diversify their assets.

Planning for retirement income is an often overlooked but necessary piece of any financial plan. Some retirees rely on stocks and bonds, others opt for annuity accounts, and many use a mixture of both in order to diversify their assets.

Annuities have grown in popularity based on their history of safe & reliable returns and the guaranteed lifetime income they can provide. There are two classes of annuities used for future payments: Immediate and deferred income accounts.

This post will mostly focus on deferred annuity accounts with a guaranteed income rider. We offer both types to address all of our client’s needs.

Deferred Annuity Income Rider Examples

Income riders are gaining in popularity as investors are better understanding these products. In a nutshell, a fixed amount (the principal) is deposited – in either a lump sum or over time – in a deferred annuity offering a guaranteed income rider. At some point later in time, the income rider is activated at the owner’s request and guaranteed lifetime income payments begin.

Let’s take a look at a very basic example of a 60 year old male who is planning for future income 10 years from now. We will use an 8% income rider and place this on a $100,000 deposit with an annuity offering a first year 10% bonus. (These are real numbers using a real annuity as of the writing of this post; future numbers might be more or less.)

Single Annuity Income Rider Illustration

| Years Deferred |

Age |

Income Account Value |

Annual Payment |

| 1 |

61 |

$118,800.00 |

$5,940.00 |

| 2 |

62 |

$128,304.00 |

$6,415.20 |

| 3 |

63 |

$138,568.32 |

$6,928.42 |

| 4 |

64 |

$149,653.79 |

$7,482.69 |

| 5 |

65 |

$161,626.09 |

$8,081.30 |

| 6 |

66 |

$174,556.18 |

$8,727.81 |

| 7 |

67 |

$188,520.67 |

$9,426.03 |

| 8 |

68 |

$203,602.32 |

$10,180.12 |

| 9 |

69 |

$219,890.51 |

$10,994.53 |

| 10 |

70 |

$237,481.75 |

$14,248.90 |

| 11 |

71 |

$256,480.29 |

$15,388.82 |

| 12 |

72 |

$276,998.71 |

$16,619.92 |

| 13 |

73 |

$299,158.61 |

$17,949.52 |

| 14 |

74 |

$323,091.30 |

$19,385.48 |

If this account owner defers his income rider until age 70, then he will receive approximately $14,250 a year or $1,190 a month for his lifetime. Assuming he lives to be 87 years old, then his $100,000 investment would have paid out $240,000 or more over his lifetime. It is difficult to find a stock, bond or certificate of deposit portfolio that would provide such guarantees.

Spousal Annuity Income Rider – Joint and Survivorship

Now let’s take a look at a similar scenario that provides income for a husband and wife – both age 60. Just as before, a $100,000 initial investment is made and the income rider is deferred for 10 years.

| Years Deferred |

Age |

Income Account Value |

Annual Payment |

| 1 |

61 |

$118,800.00 |

$5,346.00 |

| 2 |

62 |

$128,304.00 |

$5,773.68 |

| 3 |

63 |

$138,568.32 |

$6,235.57 |

| 4 |

64 |

$149,653.79 |

$6,734.42 |

| 5 |

65 |

$161,626.09 |

$7,273.17 |

| 6 |

66 |

$174,556.18 |

$7,855.03 |

| 7 |

67 |

$188,520.67 |

$8,483.43 |

| 8 |

68 |

$203,602.32 |

$9,162.10 |

| 9 |

69 |

$219,890.51 |

$9,895.07 |

| 10 |

70 |

$237,481.75 |

$13,061.50 |

| 11 |

71 |

$256,480.29 |

$14,106.42 |

| 12 |

72 |

$276,998.71 |

$15,234.93 |

| 13 |

73 |

$299,158.61 |

$16,453.72 |

| 14 |

74 |

$323,091.30 |

$17,770.02 |

After ten years, the rider is activated and lifetime income begins for the couple. Their lifetime payments would be over $13,000 a year or nearly $1,100 a month. Thus if only one spouse lives to be age 90, then their $100,000 investment would have paid out over $260,000. Again, this investment provides very appealing guarantees for those who are planning on future income.

It is also important to note that these illustrations are linear in nature. This means, all other factors being equal, if the $100,00 initial investment was doubled to $200,000, then all of the income numbers would also double.

Income Withdrawal Percentages – Single And Joint

If you look at both charts carefully, you will notice that there is a significant jump in income from age 69 to age 70 with this particular product. Like all income riders, the amounts paid to the owners are based on predetermined percentages as guaranteed by the insurance company.

In the case of the single man age 60, his withdrawal percentage jumps from 5% to 6% at age 70. And with the couple, their income withdrawal percentage jumps from 4.5% to 5.5% at age 70. Thus, the income stream can vary somewhat significantly depending not only on the product and the insurance company, but also based on the withdrawal percentages allowed by the annuity rider.

Future Income Payments That Adjust For Inflation

The annuity income rider illustrated above also offers an inflation rider that allows the future payments to increase by 3% each year.