If you’re looking for a safe and insured fixed-interest account, you’ll want to compare fixed annuity accounts to bank CDs. Both offer pros and cons depending on what features are most important to you.

The chart below compares the advantages and disadvantages of both accounts side by side. It’s important to know that fixed annuities usually offer higher interest rates than CDs. They also allow owners to defer taxes, but their surrender penalties are higher overall.

Fixed Annuity Versus Bank CD

| Investment Feature | Annuity | Certificate of Deposit |

| Safe & Insured? | Yes | Yes |

| Insured By? | State Insurance Guaranty Association | Federal Deposit Insurance Corporation |

| Insured Up To? | $250,000

Per Depositor | $250,000

Per Depositor |

| Rates Are Fixed And Guaranteed? | Yes | Yes |

| Interest Withdrawals? | Yes | Yes |

| Grows Tax-Deferred? | Yes | No |

| Can Withdrawal Principal During Term? | Yes | No |

| Fully Liquid At End Of The Term? | Yes | Yes |

| Full Death Benefit To Beneficiaries At Passing? | Yes | Yes |

| Accepts Qualified Money Like IRAs? | Yes | Yes |

| Account Can Be Stretched At Passing? | Yes | No |

| Allows Additional Deposits? | Sometimes | No |

| Offers Lifetime Income Stream? | Yes | No |

| Avoids Probate? | Yes | Sometimes |

| Penalty-Free Withdrawals For Health Expenses? | Yes | No |

| Principal Reduced By Agent Commissions? | No | No |

| Early Surrender Penalties? | Yes | Yes |

| Currently Offers The Highest Rates? | Yes | No |

Do Bank CDs Or Annuities Offer The Best Rates?

We are currently in a historically high interest rate environment. This impacts yields for all fixed-income accounts. If you have a CD coming due or are shopping for the best money market account, you know rates are high right now. Better than we’ve seen in 20 years. These higher rates are also positive for fixed annuities.

Fixed annuities can be advantageous as they are oftentimes more versatile than bank funds. They primarily invest in government treasuries, but they also purchase highly-rated corporate debt. Smaller annuity companies are even more agile. They can purchase smaller tranches of high yielding debt that might not suit larger companies.

This translates to better fixed rates for most annuities. By tapping into multiple debt markets, their portfolios offer better returns. Those returns filter down to consumers. It’s common to see a five-year annuity yield well over 5% while banks are half of that at best.

What About Safety Of Principal & Interest?

Both fixed annuities and bank CDs are safe. While they are insured by different entities, both have a solid track record of safety and reliability.

Both fixed annuities and bank CDs are safe. While they are insured by different entities, both have a solid track record of safety and reliability.

In most states, accounts are insured to $250,000 per contract. So whether it’s FDIC or your annuity State Guaranty Association, you have protection.

That being said, we are witnessing bank failures again. Two of the three largest bank failures in US history (Silicon Valley Bank & signature Bank) occurred in an instant. The largest bank failure, Washington Mutual, happened during the Great Recession of 2008.

But fixed annuities are different. They primarily purchase government treasuries. The United States government would have to default on its debt for insurance companies to lose solvency. That scenario is unlikely. The government can always print more money if it needs to.

Understanding Other Annuity Safeguards

Unlike bank deposits, most annuity accounts have what’s referred to as a Market Value Adjustment. We won’t go into great detail here; you can click on the term to learn more. But in a nutshell, this is a way for insurance companies to mark down bonds when interest rates increase. This means you’ll want to hold your annuity to maturity to capture its total value with interest.

And annuities also have decreasing surrender penalties while they mature. These penalties, along with the Market Value Adjustment, prevent runs on the insurance company. These two features are designed to protect investors and the insurance companies issuing annuities. Banks don’t do this so well as we’ve seen too many times.

Which Investment Is More Appropriate For Me?

Annuities offer more features and flexibility than CDs, but they aren’t necessarily the most appropriate account for everyone. Typically, younger consumers will purchase CDs. Annuities are more appropriate for those saving toward, near, or are in retirement.

The reason annuities might be better suited for older consumers is taxes. If you plan on withdrawing funds from your non-qualified annuity before age 59 1/2, you can face IRS penalties on top of any income taxes due. After age 59 1/2, owners can withdraw funds with no penalties. CDs do not have these restrictions.

Whether an annuity is funded with pre or post-tax dollars, owners can run into IRS issues based on this age threshold. It’s wise to consider tax implications if you’re unsure about withdrawals. We can help you better understand some of the tax implications annuities have that CDs do not.

Annuities typically have higher surrender penalties, as mentioned. If you need to withdraw more than the account allows for during its term, you might pay higher penalties than with a bank CD. It’s always a good idea to have your rainy day funds invested in more liquid products. But annuities usually allow penalty-free withdrawals for interest, some principal, and Required Minimum Distributions.

Annuities Are Ideal For Retirement Savings & Income

If you have not yet reached, but wish to save toward retirement – then an annuity account can be a wise choice. Your interest will compound through tax-deferred growth each year. Compound growth is a big advantage annuities have over CDs. All things being equal, fixed annuity accounts will be worth more at the end of their term because they grow tax-deferred.

Once retirement has been reached, your annuity balance can be converted into a lifetime stream of income if you wish. This is not required, of course. It is an option. You can also withdraw your interest each month and leave the principal intact. You might also initiate a 1035 tax-free exchange and invest in a new annuity that suits your needs.

Your accumulated principal and interest always belong to you – never the insurance company. At passing, your beneficiaries would receive the entire balance of the account as a lump sum. Your beneficiaries can also choose to receive all funds over a set period of years in order to reduce income taxes.

Contact Us Today To Learn More

Hyers and Associates is an independent annuity broker. We will help you better understand the distinct advantages annuities offer over bank CDs. We can help you compare the best rates and features with highly-rated insurance companies to see which policies are best for you.

Category: Annuities, Articles

When shopping for Medicare supplement plans, it’s important to know many providers offer spousal and/or household discounts for married applicants – or those who share a residence.

When shopping for Medicare supplement plans, it’s important to know many providers offer spousal and/or household discounts for married applicants – or those who share a residence.

These discounts usually range from 5-12% depending on the insurance company guidelines.

There are several providers offering supplemental premium discounts to those who qualify. AARP United Healthcare, Aetna, Anthem Blue Cross & Blue Shield, Bankers Fidelity, Cigna, Heartland National, Humana, IAC, Manhattan Life, Medico, Mutual of Omaha and Sentinel Life are just a few that do. (There are some carriers that do not offer any discounts no matter your circumstances.)

Couples Discounts On Medigap Insurance

The most common type of discount for Medicare supplement insurance requires both spouses make application and be accepted. Couples don’t have to choose the same plan, but both parties must enroll with same company.

For instance, one spouse may apply for Plan F and the other Plan G or Plan N. So long as both are accepted to the plan of their choice, a spousal discount will apply to each policy. The discount percentage will not differ depending on the chosen plan. If the selected insurance company offers a 5% discount, then both policies will be reduced by that amount.

Household Discounts When Only One Spouse Applies

A new trend with Medicare supplements is to offer a household discount to applicants who are living with someone else. The other household member does not need to apply (or own a policy) for the applicant to enjoy the same discount offered to couples.

In this case, living with a spouse, sibling, adult child, roommate or significant other may qualify the applicant for a premium discount. In most cases, the household member not applying must be above age 50 (sometimes 60) for the applicant to qualify. Additionally, most insurance companies will require that the two household members have lived together for at least the last 12 months.

Some states allow for a Medicare supplement household discount while others do not. It’s important to inform your agent about your living situation to see if you might qualify. Undoubtedly, there are those who are missing out on available discounts because they did not work with a knowledgeable broker.

What If One Spouse Leaves Supplemental The Plan?

Medicare supplement discounts are not usually lifetime programs. With most, you must meet the ongoing requirements of either being married and both insured – or living with someone of the proper age and for the required length of time.

In the event of divorce, death or permanent move – the applicant(s) can lose their premium reductions. Insurance companies do not necessarily audit their members, but they will be aware when another applicant is no longer on the plan for any reason.

Are There Other Medicare Insurance Discounts Available?

Another easy way to save on your supplemental insurance costs is by choosing the payment method(s) most preferred by the provider. In most cases, paying by monthly bank draft or one annual lump sum is least expensive option. If you prefer to be billed monthly, quarterly or semi-annually, then you will almost always pay more overall.

And we are often asked about premium discounts with Medicare Advantage and Part D drug coverage. Unfortunately, there are no marital or household discounts of any kind for these policies. You must pay full price even if someone you live with chooses the same plan with the same company.

It’s also important to know that some states (Florida is a good example) do not allow for spousal discounts on any of their Medicare supplement plans. It’s hard to say why, but Insurance Departments across the country all have different rules.

Contact Us For Quotes, Coverage And Direct Enrollment

There are several ways you can qualify for discounts on your Medicare supplement insurance plans and you don’t necessarily need to be married to do so. Each carrier (and state) will have their own rules and guidelines, so it’s a good idea to speak with an informed broker who represents several insurance companies to find your best deal.

It does not cost a penny extra to place your business with an agent or broker and you can end up saving money simply by being aware of the savings options available in your home state.

Compare Medicare Supplement Quotes Today →

Category: Articles, Medicare Supplements

It depends who you ask. For those selling annuities, the answer is usually yes. For those who only sell competing accounts like stocks, bonds and mutual funds – the answer is almost always no. Most everyone has some skin in the game and they’ll work hard to make the case for their products over others.

There is not a right or wrong answer to whether you should own an annuity. Investments are very subjective and what’s right for you may not be right for your neighbor. Your short and long term goals, risk tolerance and income needs are just a few of the many factors that might help to answer this question.

How Much Market Risk Can You Tolerate?

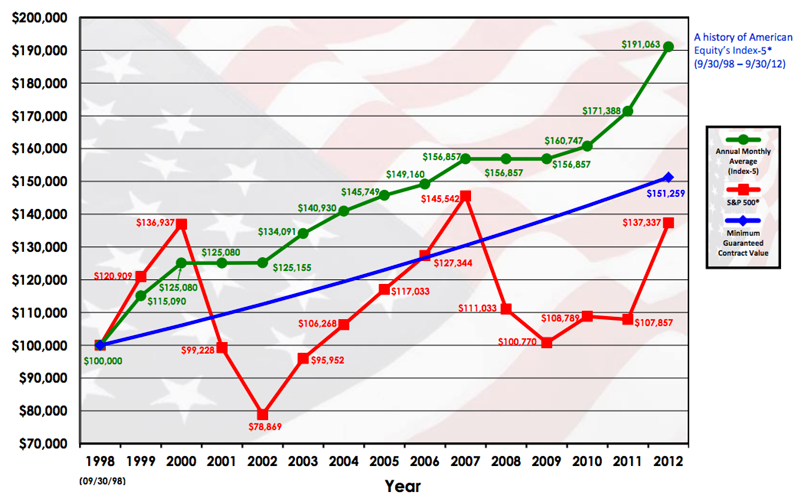

The markets have been on several wild swings over the last 15 years. Several economic, technological and political factors have increased market volatility and it’s unlikely that these startling ebbs and flows will disappear any time soon. In fact, they are becoming more frequent.

If you’re younger and don’t plan on accessing your funds for several years, maybe you can weather these unnerving downturns. But as you grow older and have accumulated a sizable nest egg, there are certainly safer places to protect and preserve your wealth than the stock market.

Fixed and indexed annuities (not variable) will decrease your overall market exposure and provide insurance against losses that can take several years to claw back. These accounts may not grow as quickly as some high-flying stocks, but the idea is to reduce your overall risk once you’ve accumulated the wealth to protect. You feel the losses much more than the gains when you are near or in retirement.

If you’re risk averse, then some annuity contracts can be a good fit. Annuities provide protection against losses and will safeguard a portion of your assets. Conversely, if the ups and downs of the market do not negatively impact your financial and mental well-being, then the markets might be more suitable. It’s subjective and it depends on your overall risk tolerance and state of mind.

In Need Of Guaranteed Income Now Or In The Future?

What are your short and long term investment goals? Is present or future income of great importance? Certainly, fixed annuities are some of the most reliable instruments in providing systematic monthly income. And indexed annuities with a deferred income rider can guarantee steady or increasing lifetime income streams in the future.

So why do some pundits argue so aggressively against these products? Most have a financial interest in competing investments, but in fairness there are some who feel there might be better ways to achieve your goals. This second group might have good intentions, but when they’re wrong – it’s your financial well-being at stake.

No one can predict how variable investments are going to perform over the long haul. This is not your grandfather’s stock market and anyone trumpeting gains from yesteryear is probably in denial about the extreme volatility of today. Investing a portion of your portfolio in an annuity suitable to your needs can guarantee systematic income now and in the future. That known income will add safety, security and diversity to an otherwise at-risk portfolio.

I Heard Annuities Have High Commissions

Yes, annuities offer commissions to the agents who sell them. We live in an incentivized world that compensates those selling financial and insurance products. The problem is that some investor-types incessantly rant about annuity commissions as a means to dissuade and distract consumers.

Almost all financial products pay commissions. Annuity commissions cover a wide range. Some are higher than others, but with a little research, you can certainly find accounts offering low compensation and high growth potential.

Fixed and indexed annuity commissions are paid to the agent by the insurance company; they never come out of your investment. If you send $100K to the annuity provider, your broker will be compensated, but your principal will not decrease. The insurance company pays the agent out of their reserves which they expect to recoup over time based on portfolio spreads.

Our advice: Don’t rule out annuities based on what the vocal minority are saying about commissions. Many pay 3% or less only one-time to the agent. This is far less than what a financial advisor would charge after only a few years of management. There are of course some that pay agents more – upwards of 7-8%. Those accounts with higher commissions tend to have longer surrender schedules. It’s important to be certain longer term annuities fit your goals and investment timeline.

Bottom line: There are very few commission-free investments. But let’s just remember that those selling stocks and bonds are not working for free – and over the course of just a few years will make far greater than the commissions mentioned above.

Do Annuity Accounts Offer Access To My Money?

“Annuities will tie-up your money and you don’t have access to your principal!” That’s a common refrain from those who would never recommend an annuity product no matter how beneficial it might be.

Yes, annuities have surrender terms and some are longer than others. Deferred income annuity accounts are usually established for the long haul in order to guarantee lifetime income for single and married investors.

The mistake some people make is putting too much money in annuities and not leaving enough liquidity in other accounts. This problem can be magnified by aggressive agents who sometimes give the industry a bad name. Annuities should be a part of a diversified, well-balanced portfolio, but not the only asset.

Annuity investments become more liquid over time which is why some investors will stagger their accounts to mature in different intervals. Before maturity however, you will almost always have access to a portion of your principal – usually a minimum of 10%. Some accounts will offer more than 10% or even a full return of premium surrender-free. If liquidity is a major concern, then a good agent should be able to find an suitable product.

Contact Us To Discuss Your Investment Needs & Goals

In a nutshell, it’s time to cut through the manufactured hype created by those who have a financial interest placing your dollars in a turbulent market. There are safer, more calming asset classes that can be more appropriate for some investors.

A well diversified portfolio should likely include stable insurance products that are not subject to the whims of the markets. Contact us today to see if an annuity might be a suitable investment for you.

Request Annuity Information →

Category: Annuities, Articles, Retirement Planning

Qualified longevity annuity contracts (QLACs) are popular retirement vehicles for those who want to create a deferred income stream later in life using pre-tax, qualified dollars.

Qualified longevity annuity contracts (QLACs) are popular retirement vehicles for those who want to create a deferred income stream later in life using pre-tax, qualified dollars.

Longevity contracts were approved by the IRS in June of 2014 and offer very attractive tax reduction strategies.

Many institutions offer these plans, but products like annuities from insurance companies are uniquely suited as they guarantee deferred future income payments.

With fewer employers offering pensions, the need for guaranteed retirement income using safe and insured investments has grown. A QLAC can be the answer for individuals and groups who wish to earmark qualified funds to create future income streams.

Longevity Annuities Grow & Lower Taxes

There are several advantages to deferred annuities including Required Minimum Distribution reductions, lower taxes, additional time for tax-deferred growth, future income streams, and simplicity.

Many investors like QLACs as they lower taxable income from RMDs at age 70 1/2 or 73 – depending on which applies to you. Your invested funds will postpone RMD withdrawals for years and allow for additional compounding tax-deferred growth. Distributions are then withdrawn later when needed or when taxable income is less.

Rules have recently changed for the amount you can contribute to a QLAC. In 2023, you are able to invest up to $200,000 so long as this amount is 25% or less of your total qualified accounts. Qualified money is from a source like an IRA, 401(k), or 403(b).

Income payments can then be deferred up to age 85. This reduces current RMD amounts while also deferring taxable income, compounding growth, and creating a much larger stream of income when it might be needed most.

Deferred income annuities are uniquely suited for QLAC as they establish a large (potentially increasing) income stream later in life.

More people are working past their 60’s and into their 70’s. It’s beneficial for some to postpone taxable RMDs until they are needed. This allows for additional time to grow your investment and a guaranteed income past your working years.

QLACs are popular as they have few moving parts. Only fixed annuities are used – no variable or indexing products are allowed. There are no ongoing fees for fixed annuity accounts and agent commissions don’t reduce your principal. (Typically agent commissions are much lower on fixed annuities when compared to variable and indexed products.)

QLAC Rules & Regulations For Tax-Deferral

A QLAC is a type of deferred income annuity, but not all deferred income annuities are QLACs. Many deferred annuities will not meet the specifications required by the IRS to be a Qualified Longevity Annuity Contract. The IRS says these parameters must be met for a policy to qualify:

- Only qualified, pre-tax money can be used – like IRA, 401(k) and 403(b) dollars

- Up to $200,000 (for 2023) – of your retirement account can be invested

- Contributions cannot exceed 25% of your total tax-qualified portfolio

- Income must be based on a single or joint life, but cannot include a period certain

- Payouts must begin at age 85 at the latest, but can begin earlier

- Variable and indexed annuities cannot be used – only fixed accounts

It’s important to know several insurance companies allow you to build in inflation protection to your annuity account. Yearly (or monthly) payments will increase by a predetermined value each year (usually 3-5%) or by changes in an inflation index like the CPI. This way, annuity owners know their payments will grow each year.

And if you established a QLAC when contributions amounts were lower, you can still invest the additional amounts in a new or existing QLAC. The IRS is allowing maximum amounts to increase most years.

What Happens To The Remaining Funds At Passing?

How your QLAC is set up will determine what happens at passing. If it’s established as a life-only plan, then all payouts will cease with no residual payouts at passing. Joint plans will continue to a living spouse at passing. And those with a cash refund would return any remaining funds to your named beneficiaries at passing.

Single-life annuities offer the largest payouts. If you’re concerned about your beneficiaries inheritance, then establishing a cash refund is prudent. If you pass away before your income stream has begun, the accumulated value (principal & growth) goes to your named beneficiaries.

To be clear: It is only when you set up a “life only” plan will the insurance company keep any residual funds at passing. Life-only plans are not very common and only used when an owner is more concerned with maximum income.

Contact Us For Quotes, Illustrations & Additional Information

Several large, well-known annuity carriers offer QLACs including: AIG, American General, Brighthouse, Lincoln Financial, Mass Mutual, Mutual of Omaha, New York Life, Pacific Life, Principal, Western Southern, and a few others.

We work with all of these carriers and can help you find the deferred income annuity that best suits your long term needs. Contact us today for more information.

Category: Annuities, Articles, Retirement Planning

If you’re looking for asset based long term care plans with supersized growth opportunities, you’re in the right place. There are now two companies offering indexed LTC annuity plans.

If you’re looking for asset based long term care plans with supersized growth opportunities, you’re in the right place. There are now two companies offering indexed LTC annuity plans.

One America State Life issued the first hybrid long term care annuity and EquiTrust recently released its proprietary version. Both credit interest based on the performance of certain indexes – like the S&P 500.

This is good news for those interested in comparing hybrid annuities. Owners can now benefit from increased returns and larger payouts for long term care expenses.

The Evolution Of Indexed Hybrid Annuities

First, there were simple fixed annuities that worked much like bank CD’s. Then there were fixed-indexed annuities that offered enhanced growth prospects without exposure to downside market risks. Next came hybrid long term care annuities that could only increase in value based on declared fixed interest rates.

But now, finally, there are indexed hybrid LTC annuity accounts. These policies offer the best of all worlds. We’ve written about hybrid annuities extensively and think they offer a great alternative to traditional long term care. You can read more about hybrid products here.

We’ve also written extensively about indexed annuities and what investors can expect from these popular accounts. You can learn more about indexed accounts here. Until recently, there hasn’t been much competition for hybrid LTC coverage.

Consumers who are interested these products now have options. These unique accounts offer the ability to grow principal – and long term care benefits – by more than what’s offered by fixed interest policies.

Popular Features Of Indexed LTC Annuity Accounts

The most important feature is index-linked growth.

The most important feature is index-linked growth.

Indexed annuities offer opportunities to earn more when markets are going up. In great years, double-digit returns are possible.

But when the market goes down, your annuity value does not go down with it. Your interest growth is locked in each year and cannot be lost in future years. The annuity credits interest on your policy anniversary and then resets for a new year.

There is a fixed account available as well. You can invest in both fixed and indexed accounts in the same year. To diversify, you can invest a portion of your premium into the indexing accounts and the remaining funds in the fixed account. You can reallocate in future years on your policy anniversary. There are no charges/fees for reallocation.

When your annuity grows, your long term care benefits also grow. That’s the goal. Invest in a policy that keeps up with inflation and provides substantial LTC benefits in the future. Many of our clients prefer growth options. This way they have more control over growth and can maximize future benefits.

These accounts from EquiTrust and State Life also allow for joint ownership. This eliminates the need for funding two policies when only one might be needed. You and your spouse can combine funds and put more money to work. And both spouses can draw LTC benefits from the annuity at the same time. That is a unique feature among many asset based LTC policies.

Other Important Features:

- LTC benefits are available in all settings like: your home, assisted living, nursing home, etc.

- Continuation of benefits (COB) rider allowing you to double your benefit pool

- Lifetime benefit option that pays for LTC no matter how long you need it

- Optional inflation protection can be purchased on COB rider

- Increased benefits pools for healthy behavior

- Accepts non-qualified funds, IRA’s and existing annuities

- Tax-free withdraws for qualified care (IRA’s excluded)

- Accepts only single premium deposits – cannot be funded over time

What If I Don’t Use My Policy For Long Term Care?

The answer to that is one of the primary benefits of asset based LTC insurance. If you don’t use or need them, then they pass to your named beneficiaries. This is much more advantageous than paying into a traditional long term care policy each year. And most importantly, you never have to worry about rates going up with a hybrid annuity. Your single premium pays for everything all at once.

And of course, you could always cash in your annuity or transfer the account value to another policy if you wish. It is a ten-year plan, however, so it would be subject to surrender charges in the first ten years other than for death.

Taking withdraws for long term care purposes is never subject to surrender fees. LTC benefit withdrawals can begin after one year. The annuity offers ten percent free withdrawals each year penalty free as well. Most of our clients avoid withdrawals (other than for long term care) as they want their annuity to grow each year.

Contact Us For Quotes, Illustrations And Information

These unique annuities from State Life and EquiTrust offer a lot of what our clients are looking for. Policy growth, larger benefit pools, wealth transfer, joint ownership, and healthy rewards are just some of the high points.

Our independent insurance agency specializes in hybrid long term care and asset based insurance planning. Please contact us for comparisons, illustrations, and information today!

Category: Annuities, Articles, Long Term Care Insurance

It’s an interesting question. In our experience offering hybrid long term care coverage, the answer is: It depends. Some of our clients benefit more from an annuity and others from a hybrid life insurance plan. We will discuss the pros and cons of each below.

It’s an interesting question. In our experience offering hybrid long term care coverage, the answer is: It depends. Some of our clients benefit more from an annuity and others from a hybrid life insurance plan. We will discuss the pros and cons of each below.

Some of the answer can also be found in your own personal comfort level with insurance. For better or worse, many LTC shoppers are more familiar with annuities and therefore gravitate toward these policies.

Sometimes life insurance plans have negative (and in our opinion undeserved) connotations. There are a lot of insurance “experts” who will tell you to buy term life insurance only, but that’s short-sighted.

You should keep an open mind and not approach your research with a bias. Buying hybrid long term care insurance is all about maximizing leverage and creating tax efficiencies. In some cases life insurance plans will offer more leverage on your invested dollars. These policies also provide additional tax advantages.

The Case For Hybrid Long Term Care Life Insurance

There are several different carriers offering hybrid life insurance. It’s important from the start to know there are two very different distinctions when it comes to these policies. Some life plans sold today simply offer an accelerated death benefit. In other words, you get some access to the death benefit amount if you meet certain requirements. In our opinion, these plans are more life insurance than long term care.

The second types of policies are true hybrids and are more long term care than life policy. We will be focusing on these types of coverage. They offer investment leverage, inflation protection, spousal options, and are considered qualified LTC plans. A qualified LTC plan will offer tax advantages when the policy is established and also when it pays out benefits to the owner(s).

Life Insurance Is Income Tax Free At Passing

Hybrid life insurance plans can be desirable simply because they offer tax advantages at passing. Any growth in a hybrid annuity is taxable as income at passing, but that’s not the case with life insurance. Should you invest a $100K single premium in a life plan and create a $250K death benefit, that $250K would not be taxed as income at your death. That is a big advantage life insurance policies offer over annuities.

Life insurance policies can also provide more leverage in some instances. When purchasing long term care insurance, one of your primary goals should be maximizing your benefit pool. Life insurance can accomplish this more efficiently when compared to some, not all, annuity plans. If the life policy provides a $250K pool of long term care benefits and the annuity only $230K, and all other things are equal, the hybrid life plan might be the better choice.

But insurance companies have more on the line when it comes to life insurance. If you purchase and qualify for a plan today and pass away tomorrow, then the insurance company will come out on the losing end of the transaction. Because of this, medical underwriting is more stringent with hybrid life plans when compared to most annuities. The immediate increase in your leveraged dollars requires more due diligence on the part of the insurance carrier.

In a nutshell, hybrid life insurance plans are popular for their tax-free death benefits, increased leverage and larger long term care benefit pools, but they have more medical underwriting.

The Case For A Hybrid Long Term Care Annuity

Hybrid annuities deserve a seat at the table when you’re considering asset based long term care. They also offer leveraged payouts and yearly growth opportunities through interest gains. While they don’t offer an income tax free death benefit like life insurance, they can still be purchased as tax-qualified plans.

And this is one of the significant factors that make hybrid annuity accounts more desirable than life insurance plans. Annuities will accept transfers from other annuities on a tax free basis. This is called a 1035 tax free exchange. While you can perform this same transaction with the cash value in life insurance plans, it is rare for someone to have $100K cash value in a life insurance plan that they want to transfer over to a hybrid policy.

Hybrid Annuities – Leveraging Tax-Deferred Assets

It’s not as rare for someone to have $100K in an annuity. As an agent, oftentimes I will hear that this same $100K is earmarked for long term care expenses.

It’s not as rare for someone to have $100K in an annuity. As an agent, oftentimes I will hear that this same $100K is earmarked for long term care expenses.

That’s great, you’re planning ahead. But why not leverage those dollars 2 or 3 times over and watch them grow each year? That way, if you spend your $100K, you can then spend another $100K-$200K of the insurance company’s money.

And that’s what LTC planning is all about. Protecting your assets, leveraging your dollars and spending the insurance company’s money – not yours – is paramount.

You might ask, what happens to the taxable gains in an old annuity when it’s exchanged for a hybrid annuity account? The investment growth is not taxed upon transfer (when using a proper 1035 exchange) and the growth is not taxable when the payouts are used for long term care purposes. It’s a win win.

And as we stated before, some LTC shoppers are simply going to be more comfortable with annuities. They are more of a known quantity with less moving parts and may simply provide more peace of mind. There’s nothing wrong with that. Don’t let someone put your hard earned dollars into something you are not comfortable with over the long haul.

The Case For Any Hybrid Long Term Care Insurance Plan

If you are planning for LTC with an asset based approach, then either a hybrid annuity or life insurance plan will offer meaningful estate protection. They will both serve the purpose of leveraging your invested dollars and providing a significantly larger pool of money.

And more importantly, these plans can be funded with a one-time single premium so you never have to worry about future premium increases like you would with traditional long term care policies. And most hybrid plans also offer a return of premium – or at the very least access to your investment should you need it.

Additionally some hybrid plans also offer joint coverage. In other words, both you and your spouse can be covered under one policy. With traditional long term care, that’s usually not the case. Those policies may offer a shared care rider, but you have to use your policy up first before tapping your spouse’s policy. Joint hybrid policies allow both spouses to draw from the same pool of money at the same time. Hybrid plans allow you to invest less in one policy than more in two.

Hybrid plans also accept 1035 tax free exchanges from existing insurance policies like annuities and life insurance. This can help you leverage an under-performing asset while also providing estate protection for you, your spouse and your heirs. No longer will you need to self-insure for such a potentially large out of pocket expense.

Contact Us To Compare Hybrid LTC Quotes And Illustrations

Hyers and Associates is an independent insurance agency offering LTC quotes and coverage direct from several carriers. We can help you compare plans side by side in order to find the hybrid policy that best fits your needs and goals. Contact us today for a free consultation.

Category: Annuities, Articles, Long Term Care Insurance, Retirement Planning

The Pension Protect Act (PPA) was passed by Congress in 2006 and became effective in 2010. The law provides tax advantages for consumers who wish to purchase a long term care policy using a non-qualified annuity policy.

The provision in the I.R.S tax code allowing for this is called a 1035 tax free exchange. Consumers can use this provision in different ways to purchase a long term care policy with an annuity on a tax advantaged basis.

What Is the Significance Of The Pension Protection Act?

When consumers contact our agency, they generally want to know more about the Pension Protection Act and how it might help them. In short, long term care expenses (specifically Medicaid costs) are major outlays for federal and state governments

The PPA encompasses a lot, but one major purpose was to incentivize the purchase of LTC insurance. Federal and state governments would much rather have consumers and insurance companies pay the costs of extended care than these same consumers spend down their assets and then turn to Medicaid for assistance. (Medicare only partially pays for the first 100 days of skilled nursing care, but nothing more.)

The Tax Benefits Of The Pension Protection Act

The PPA helps consumers who are interested in purchasing long term care in several ways. The primary advantage is the tax incentives provided by this law.

The PPA helps consumers who are interested in purchasing long term care in several ways. The primary advantage is the tax incentives provided by this law.

It also offers flexibility for those with existing assets earmarked for long term care expenses. In a nutshell, the interest gains from non-qualified annuity accounts can now be used on a tax-free basis to either fund or purchase a traditional or hybrid long term care insurance policy.

(A non qualified annuity is one where the initial investment was made with post-tax dollars. This is unlike a qualified annuity – like an IRA or 403b – where the investment was made with pre-tax dollars).

Using A Non-Qualified Annuity To Purchase Traditional Long Term Care Insurance

If an individual purchases long term care by simply writing a check from his or her bank account each year, then there are no taxable benefits or deductions. However, if a non-qualified annuity is used to make this same purchase, then the interest gains from the annuity can be used tax free.

There are two ways to do this. The first method is to purchase an immediate annuity and send all (or a portion) of the systematic yearly payments to the insurance company offering the LTC plan. An immediate annuity provides payments consisting of principal and interest – so long as the interest is used to pay for the LTC policy, then it would not be taxed as ordinary income. In some cases the annuity and the LTC insurance can be bundled and purchased from the same company.

The second method is to make yearly withdraws from an existing non-qualified deferred annuity that was purchased some years ago. For example, a $150,000 annuity (with a $100,000 cost basis) would have $50,000 in deferred gains. The owner could execute a partial 1035 exchange (taking out a portion of the $50,000 that would normally be taxable) and use those funds to pay for the LTC policy on a tax-free basis each year.

There are some rules that must be followed in order for these two strategies to work. The LTC policy must be “tax qualified” (most are) and the LTC provider must be able to accept the funds from the annuity subject to the I.R.S. 1035 exchange rules. If the annuity owner takes constructive receipt of the payments first, then these strategies will not work. It is important to work with a knowledgeable agency like ours when setting up these types of transactions so as to avoid taxable mishaps.

Transferring To A Hybrid Long Term Care Annuity

When interest rates are low, then the savings described above may not be very significant if the annuity is not generating large amounts of taxable interest. However, the 1035 exchange rule can be very beneficial if an owner of an existing annuity wants to exchange their traditional policy for a hybrid long term annuity.

Hybrid annuities are somewhat new and they are gaining popularity very quickly. Many consumers are worried about purchasing a traditional long term care policy because of costs, rising premiums and the idea that it may never be needed. Hybrid LTC annuity accounts help to avoid these issues.

Consumers can exchange an old non-qualified annuity account for a hybrid long term care annuity using the same 1035 exchange rule. When setup properly, this exchange generates no taxable gains. Using the example above, the $50,000 gains would transfer tax free to the new hybrid policy.

But wait, there’s more. The $50,000 gains could be withdrawn later on a tax free basis to cover the insured’s long term care expenses – like care in an assisted living facility, nursing home or the annuity owner’s own home. Additionally, hybrid long term care annuities will leverage the deposits by a factor of 2-3X over providing the potential for much larger LTC benefits than the policy from which they came.

This can be a very good strategy for those who have an existing annuity earmarked to pay for long term care expenses as well as for those who wish to self-insure. Why take taxable withdrawals from a non-qualified annuity to pay for LTC expenses (i.e. nursing home care) when you can take tax free withdrawals from a hybrid LTC annuity?

(It is important to note that there is some medical underwriting required with hybrid LTC annuity accounts. Consumers must purchase them while in reasonably good health – otherwise they can be declined as is the case with any health insurance policy. It is best to be proactive when purchasing LTCi.)

The Pension Protection Act & Life Insurance Cash Value

While somewhat less common, consumers can also use the cash value in their life insurance policy to fund a long term care policy and still be in compliance with the PPA. This would also be done using the I.R.S. approved 1035 exchange rules.

Again, it’s important that the long term care insurance company be able to accept the funds from the life insurance company as a 1035 exchange. This could be done as a lump sum (thus surrendering the life policy) or through a systematic withdrawal. When taking withdrawals from a life insurance policy, it’s important to understand how the integrity of the policy will be affected.

Contact Us For Quotes, Illustrations And Assistance

First, we must stress that the agents at Hyers and Associates are not tax advisors nor is this article intended to offer actionable tax advice. While we are familiar with tax rules and regulations as they apply to insurance policies, it is always advisable to talk with your own tax advisor before making exchanges.

That being said, we can help those who are interested in purchasing long term care insurance using non-qualified annuities and life insurance. The Pension Protection Act is a valuable piece of legislation incentivizing these unique transactions. Contact us today to learn more.

Category: Annuities, Articles, Long Term Care Insurance

Understanding monthly point to point annuity with cap accounts is very important if you are a current or potential indexed annuity investor. Typically, these accounts offer some of the highest potential for yearly returns when markets steadily trend upward.

This post is the second in our ongoing series discussing indexed annuity sub-accounts. Our first was an explanation of the yearly point to point (PtP) account. The monthly version works a bit differently, but in the right market environment, it can credit significant returns.

Indexed Annuity Investment Sub-accounts

Hopefully, you are well read on the pros and cons of indexed annuity investing. We are taking it a step further here and describing how a point to point sub-account credits interest to indexed annuities. (See Chart Below)

Almost all indexed accounts offer the PtP option. And some offer it for different market indexes like the S&P 500, NASDAQ or Dow Jones – all within the same annuity. The PtP option (like most investments) performs best when the market is climbing steadily with few significant declines.

Explaining The Monthly Point To Point Annuity Account

It’s important to note that not all PtP accounts work in the same manner, but for the purposes of this article, we will explain the most common type and its yearly interest crediting method.

It’s important to note that not all PtP accounts work in the same manner, but for the purposes of this article, we will explain the most common type and its yearly interest crediting method.

First, you must understand that the PtP is almost always a yearly account. No interest is credited until your 12 month term has been reached. Oftentimes, consumers see the word monthly and think the account will credit interest each month. This is not the case.

The monthly point to point annuity account credits interest yearly based on the performance of the chosen index – usually the S&P 500. The yearly interest credit is calculated by adding the monthly gains (subject to cap) and subtracting the monthly losses (no cap) each month – usually over a twelve month time period. This twelve month time period will not necessarily track the calendar year.

How A Monthly Cap Affects Your Indexed Annuity Gains

Not all annuity sub-accounts have a monthly cap, but the point to point account almost always does. If the monthly gains in the S&P 500 are the gas that power your returns, then the monthly cap is the brake. An annuity cap is a very important number and investors need to work with an agency like ours to find the best one.

It’s as simple as this: The lower the cap, the lower your potential for gains. The cap is not your friend; it’s the mechanism insurance companies use to hedge against losses and remain profitable so that your money stays safe & insured.

Monthly Point To Point Annuity Example

The easiest way to explain how interest is calculated and credited to your annuity is by a hypothetical example. Most of 2013 was a very good year for investing in the overall markets. The market went up most months, there was little volatility, and the bad months weren’t too bad in comparison to some years in the past.

2013 S&P 500 Annuity Point To Point Performance Chart

| Month |

S&P 500 Return |

Annuity Cap |

Cap Applies? |

Annuity Gains |

| Jan |

5.04% |

2.50% |

Yes |

2.50% |

| Feb |

1.11% |

2.50% |

No |

1.11% |

| Mar |

3.60% |

2.50% |

Yes |

2.50% |

| Apr |

1.81% |

2.50% |

No |

1.81% |

| May |

2.08% |

2.50% |

No |

2.08% |

| Jun |

-1.50% |

2.50% |

No |

-1.50% |

| Jul |

4.95% |

2.50% |

Yes |

2.50% |

| Aug |

-3.13% |

2.50% |

No |

-3.13% |

| Sep |

2.97% |

2.50% |

Yes |

2.50% |

| Oct |

4.46% |

2.50% |

Yes |

2.50% |

| Nov |

2.80% |

2.50% |

Yes |

2.50% |

| Dec |

2.36% |

2.50% |

No |

2.36% |

| Total |

26.55% |

N/A |

N/A |

17.73% |

So what do the numbers in the chart above mean? In a nutshell, the S&P 500 gained 26.55% (excluding dividends) in 2013 – and an indexed monthly point to point annuity with a 2.50% cap would have returned 17.73% during that same time period. Are these gains realistic? In a word yes, but of course 2013 was a good year in the market and was not the norm over the last decade.

As with all insured indexed annuities, you are sacrificing some gains for safety, stability and peace of mind. You would not expect returns of 17% on a regular basis, but it is comforting to know they are possible and that you will never experience market losses of any kind – ever.

Is There A Downside Cap To My Indexed Annuity Gains?

Yes, you can never go below zero – no matter how far the market tumbles. One bad month can erase all of your monthly gains for your 12 month term, but your account will not decrease in value overall and your gains from prior years are locked in.

In other words, you can have a year with no gains when investing in a monthly point to point annuity, but not a year where your account loses money. Your premium bonus and gains from prior years are locked in and not subject to market downturns.

You can see in the chart above that there are no downside caps for months where the S&P 500 turned negative. The worst case scenario is that you could be having a good year, but a big market correction could wipe out all of your paper gains from the first 11 months. In this instance, your annuity would not credit interest, but even if the market was down overall, your annuity would not lose value.

Contact Us For Annuity Quotes And Information

Hyers and Associates Inc. is a full service insurance agency specializing in indexed annuity accounts. We can help you compare the caps, bonuses, terms and all other details of the indexed annuities that are most likely to offer the best performance.

Category: Annuities, Articles, Retirement Planning

In response to market demand, several insurance companies are offering annuity accounts with a guaranteed death benefit rider. These new riders increase the contract value each year by a guaranteed interest rate.

The annuity death benefit proceeds will be passed on to the insured’s beneficiary(s) in a lump sum – or over the course of a predetermined number of years. Those who are looking to lock-in gains and transfer wealth might consider an annuity death benefit rider.

What Does An Annuity Death Benefit Rider Guarantee?

These riders simply guarantee a yearly increase in the annuity death benefit amount each year for a certain time period.

These riders simply guarantee a yearly increase in the annuity death benefit amount each year for a certain time period.

A common rider would increase the account value each year by 5% for a set number of years (usually ten).

Some companies allow the insured to re-up the rider for another ten years, but most contracts stop rolling up once the annuity owner turns age 85. Each policy is a little different.

The death benefit rider will not change once it has been added to the contract. The annual roll-up will not increase or decrease for the ten year period. The cost (if there is one) stays the same as well. After the ten year term, the annuity owner can decide to re-up once the new rates are established.

How Are The Annuity Benefits/Proceeds Accessed?

Upon the death of the insured/annuitant, the insurance company pays the contract beneficiary(s) the death benefit amount either in a lump sum or over a set number of years. Usually the minimum number of years needed to access the total benefit is 5 years.

In some cases, the annuity beneficiaries will have a choice. They can take a smaller sum all at once – or a larger sum over 5 years. Annuity owners who are looking to transfer wealth over a period of time might deliberately establish a 5 year payout for the next generation. This can be an advantageous strategy with accounts that have not yet been taxed – like IRA’s.

If the annuity owner passes away before the ten year term has been completed, then the death benefit would only be calculated for the time the contract was in force – not the entire ten year term.

What Is the Cost For An Annuity Death Benefit?

These riders usually have an annual cost to the contract itself, but this cost does not lower the amount payable at death. Depending on the insurance company and the rider chosen, an average annual cost for a death benefit rider would be in the .70% – 1.10% range.

The annual cost means there are two accounts at work. The first is the walk-away value of the contract. The walk-away value is the amount payable to the insured if s/he surrenders the contract for some reason. The annuity death benefit rider will decrease the walk-away/surrender value each year should the owner cash-in or transfer the annuity.

The second value is the death benefit amount. This value compounds each year and is payable at death. Again, some annuities will offer this value in a lump sum while other accounts will require a 5 year payout.

The two values (walk-away & death benefit) will almost always be different. It is likely that the death benefit amount would be larger in the long run because there are no market risks, fluctuating interest rates, or annual costs to stunt its growth.

Annuity Income Riders With Death Benefits

In some cases, annuity death benefit riders are packaged with an income rider. This offers annuity owners more flexibility as they can access the death benefit value (if needed) by creating a lifetime income stream.

In many cases, the lifetime income stream might be the primary reason the rider was purchased. The increasing death benefit is a desirable feature, but guaranteed lifetime income during retirement might be the primary goal for some retirees.

This acknowledges the fact that annuities are not the most efficient investment for wealth transfer; that vehicle is life insurance. Life insurance is far and away the most efficient product for creating and transferring wealth on a tax-free basis. Readers can learn more about the use of life insurance for wealth transfer here.

Contact Us For Annuity Quotes

Fixed and indexed annuities offering an increasing death benefit can be a valuable feature for those looking to guarantee yearly gains, establish a lifetime income stream or pass an existing tax-deferred asset to the next generation.

At Hyers and Associates, we recognize that one size does not fit all when it comes to insurance and investment planning. Our independence allows us to help our clients find the most suitable products that best fit their long term needs and goals.

Category: Annuities, Articles, Retirement Planning

If you own or are considering investing in fixed-indexed annuities, it is important to understand how a point to point annuity sub-account works. In this post, we will discuss how these accounts operate and what investors can expect from them.

Considered the most conservative of most indexed annuity investment options, point-to-point accounts are the least complicated. There are no unusual formulas or difficult calculations to understand. Any money invested in a point to point account will have a beginning and end point that is used to calculate an interest payment.

Indexed Annuity Point To Point Annuity Accounts

Typically, indexed annuities track a market index like the S&P 500, DOW Jones or NASDAQ. Should the tracked index rise, the insurance carrier will take the percentage difference between the beginning and end points in order to calculate an interest credit to the annuity.

For example: Let’s take $100,000 invested in a one year point-to-point account with no cap that tracks the S&P 500. If the value of the S&P 500 was 1500 when you funded your annuity and 1650 one year later, then that would be an increase of 150 points. This translates to a 10% increase.

Assuming no other variables, the point to point annuity would credit 10% interest growth and the account would be worth $110,000 one year later. The account would then reset for a new one year term. If in year two, the S&P 500 dropped back to 1500 from 1650, then no interest would be credited and the account would stay at $110,000 and reset using 1500 as the new starting point for the third year.

Annuity Caps, Spreads And Participation Rates

Other than the beginning and end points, the other factors to consider are any caps, spreads or participation rates that are applied after the term of the account has ended. Most (not all) indexed annuities will have some kind of ceiling or limiting factor on the amount of interest growth that can be credited to the account after the term is over.

If the insurance company had a 6% cap in the one year hypothetical example above, then the account would only have credited 6% in as that would have been the ceiling for growth. After year one, the account would be worth $106,000 (not $110,00) and everything else would remain the same. In other words, you would have only been credited 6% – not the 10% actual growth in the index itself due to the yearly cap.

Other insurance companies will use participation rates or spreads to hedge their risk when issuing a fixed-indexed annuity. Using the same example above with a 50% participation rate and no cap, the owner would only be credited 50%. The growth in the index was 10%, but 50% of that growth (or 5%) was the maximum stipulated in the contract.

On the other hand, a spread a could be 1.5% in a typical indexed annuity. This means that 1.5% of the 10% growth is not credited to the account. Using the example above, the owner would be credited with 8.5% growth (10% – 1.5% spread = 8.5% interest rate) at then end of one year.

Annuity investors should know that most insurance companies will use either a spread, cap or participation rate to calculate yearly interest, but not all three. And these numbers will be known at the beginning of the term – they are not a secret. While they can change from year to year, they are always stated at the beginning of the point to point term.

Annuity Indexing Options, Term Length & Interest

Most annuities offering a point to point sub-account calculate interest over a one year period of time, but there are some accounts that credit interest after a two year (or longer) term. Some can be as long as five years.

The advantage of point to point annuity accounts with longer terms will generally be higher caps, spreads and participation rates. The higher these numbers, the more potential interest growth for the investor.

Most fixed-indexed annuities will track the S&P 500, but there are many that track different indexes or a combination of indexes. Some annuities track the major indexes here in the U.S. and others will offer foreign indexes as an option. More indexing options will provide more opportunity for growth should one area of the economy be performing better than another.

Understanding Fixed-Indexed Annuity Accounts

It is important to remember that unlike variable annuities, mutual funds and stocks and bonds – fixed indexed accounts are safe and insured. Any interest gained in an indexed annuity can never be lost due to market fluctuations or corrections. You never own any stocks in the index – indexed annuities are not variable accounts and cannot lose money due to market fluctuations.

Annuity accounts may not make you fabulously wealthy. They are more conservative in nature and are designed to offer higher potential interest than a C.D. (or fixed annuity) without any additional risk to your principal. While interest returns can be in the double digits in very good years, it would be unreasonable to expect an indexed annuity to average double digit returns for the overall term of the contract.

Should you be considering investing in a point to point annuity, contact us and we can help you find the account that best suits your needs and goals.

Category: Annuities, Articles, Retirement Planning

Tags: point to point annuity, point to point indexed annuity

There are several types of retirement annuity accounts offered from various insurance companies. The one that will work best for you will depend on your short and long term financial goals.

There are several types of retirement annuity accounts offered from various insurance companies. The one that will work best for you will depend on your short and long term financial goals.

If you are closer to or at retirement, then a single premium immediate annuity account might be best. If you are saving toward retirement, then a deferred annuity with an income rider might be more appropriate.

Simply put, one size and type of annuity does not fit all situations. At Hyers and Associates, we work with a wide array of insurance companies in order to find the highest yielding annuities that best fit our client’s needs and goals.

Tax Deferred Retirement Annuity Accounts

Tax deferred annuities are best for those who are saving toward retirement and wish to accumulate funds that can later be used to generate a guaranteed income stream. Deferred annuity accounts accept both pre and post tax monies – either way the account will not be subject to income taxes until distributions are taken.

Non-qualified annuities (post-tax) are a common type of retirement annuity used for savings and accumulation. These accounts take advantage of compound growth and there are no requirements for when distributions must be taken. Owners can defer earnings and grow their retirement nest eggs for as long or as little as needed.

Fort those who have maxed out contributions to their retirement accounts, a non-qualified tax deferred retirement annuity can be a valuable investment. Contribution amounts are limitless, all funds compound on a tax-deferred basis and there are no distribution requirements.

Depending on your risk tolerance, a fixed, equity indexed, or variable annuity can be used to save toward retirement. In order to balance risk, some investors will use more than one type of account.

Lifetime Income With Certain Annuity Riders

We have written extensively about annuity income riders as these products offer a valuable way to grow your investment in order to later create a lifetime stream of income.

We have written extensively about annuity income riders as these products offer a valuable way to grow your investment in order to later create a lifetime stream of income.

Several insurance companies offer income riders and they can be attached to fixed, fixed-indexed and variable annuities depending on your risk tolerance.

Income riders offer a safe and reliable way to save toward retirement. In a nutshell, income riders create a sub-account that is guaranteed to increase by a known percentage each year (say 7%). The sub-account can be activated at desired future time to create a lifetime income stream.

The sub-account is typically not available for full withdrawal, rather it is used to create lifetime income for the owners. Theses riders usually have a yearly cost (say .70) to the walk-away value of the contract, but those costs are not deducted from the income sub-account.

In this way, there are always two values at work; the walk-away amount and the sub-account value. We can illustrate both for our clients so they can better understand what to expect from these types of retirement annuities.

It is also important to note that some lifetime income riders are also offering leveraged protection for long term care expenses, inflation protection, and in other cases full access to the sub-account value if it’s taken over a period of years. The bottom line is these riders offer known and dependable future lifetime income for their owners.

Learn more by visiting these pages:

https://www.ohioinsureplan.com/annuities/annuity-income-riders/

https://www.ohioinsureplan.com/annuities/deferred-income-annuity/

Immediate Income Annuities During Retirement

If you are at or very near retirement, then an immediate annuity might work best to create retirement income. Many consumers use these accounts to generate systematic payments for a set number of years – if not a lifetime.

The acronym used by insurance professionals is SPIA: Single Premium Immediate Annuity. SPIA accounts are usually funded with a lump sum investment in order to create a desired stream of income for one or two lives.

There are several ways to structure an immediate annuity to best fit the needs of the investor. Payments can be made for a set number of years (period certain), a lifetime, or a lifetime with period certain. Invested funds will earn interest before distribution and in some cases payments can be adjusted upwards for inflation each year.

We work with several SPIA providers in order to find the best payouts from the most highly rated insurance companies.

Contact Us For Annuity Information

Hyers and Associates is a full service, independent annuity agency. We offer fixed, indexed, immediate and income annuity riders from many, many carriers. We can help you compare and understand the policy(s) that may best fit your retirement needs.

Category: Annuities, Articles, Retirement Planning

Tags: retirement annuities, retirement annuity

We have written extensively about the benefits and limitations of annuity income riders. There is a lot to learn about these accounts and we do our best to educate consumers online, over the phone and in person.

The purpose of this article is to discuss some of the innovations with newer income riders. Not all are created equal, but we help tailor our recommendations to what best fits your short and long term investing goals.

Summary Of Traditional Annuity Income Riders

First, a little background: Annuity income riders are usually separate riders purchased along with a fixed or indexed annuity account. Some are free while others have an annual cost deducted from the walk-away value of the contract.

An income rider creates a separate account (sometimes referred to as a ghost account) that increases each year at a predetermined rate – say 7%. After some years of deferral, the income account is activated and it creates a lifetime stream of income for the annuity owner(s).

In other words, there are two accounts with two separate values at work. One that the owner (or beneficiary) can withdraw lump sum and the other that is used to create a lifetime stream of income. If you would like more information about how these account work, please click here.

Leveraging Income For Long Term Care Expenses

Some new annuity income riders will leverage their payouts in order to account for long term care expenses. Should the income rider be activated and the insured be confined to a nursing home, then some contracts will triple the systematic payout for a maximum of 60 months.

There is no medical underwriting necessary for this feature; it is just an added benefit to help account for LTC costs. After 60 months, the income rider would revert back to its normal payment for the life of the insured(s) even if the annuity and/or ghost account was depleted.

Unfortunately, most riders that allow for a leveraged long term care payouts will only cover care in a nursing home environment. In the future, perhaps some riders will also leverage for home health care and assisted living.

It should be noted that there are traditional and hybrid policies that are more geared toward solely accounting for long term care costs. They will offer more flexibility and features than the income riders mentioned above.

Turning Income Off And Retaining Proceeds

One of the benefits of an annuity income rider is flexibility. These riders can be placed in deferral for several years in order to maximize future income. Once the income has been turned on, many riders allow the owner to turn it off and then back on later as needed.

In some cases, the accumulated income not withdrawn while the rider has been turned off can be accessed lump sum at a later date. If for example an activated income rider paying $10,000 a year was turned off for three years – the owner could withdraw $30,000 in a lump sum when the rider was reactivated.

This can be helpful for those who need the flexibility and accessibility of large sums of money at different times. This could be due to tax implications or inherited wealth or any other number of reasons. Most importantly, it is not a use it or lose it proposition for the annuity owner if income is turned off.

Adjusting Annuity Income For Inflation

Depending on your future income needs, it may be necessary for the systematic payments to increase year over year. Insurance carriers have accounted for this need in different ways so that your income can ratchet up over time.

Some riders will simply start at a lower rate and then increase by 3% each year. In other cases, income can grow based on the performance of the annuity itself. And others will track a known inflation indicator like the CPI and adjust future income based on its movements.

Constant and steady income may be right for some while income that adjusts for inflation might be better for others. There is always a trade-off when introducing new features to an income rider, but the important factor is that annuity owners have a choice.

Contact Us For More Information

Hyers and Associates is a full-service, independent provider of fixed and indexed annuities. We do the shopping for you. It does not affect your returns in any way to use our agency for your annuity transaction.

We will help you compare the various annuity riders and options available in your state of residence so that you may invest in the account that best suits your present and future needs.

Category: Annuities, Articles, Retirement Planning

Now that the Supreme Court has upheld most of the provisions in the Patient Protection and Affordable Care Act (otherwise known as Obamacare) high income investors can expect to pay higher taxes on most investments.

Legislative changes of this magnitude certainly come at a cost and in order to pay for Obamacare, investors must now share more of the burden in the form of a 3.8% surtax on investment income. This will be in addition to any future rollback of the Bush tax cuts already proposed for the wealthy.

Explain The Obamacare New Investment Tax

This new tax that was passed in 2010 when Democrats controlled the House, Senate and Executive branches and affects joint filers with adjusted gross income of more than $250,000 and single filers with income above $200,000. Earned income amounts above these thresholds will be subject to the new tax, but income below will remain at current levels.

The tax is slated to begin January 1, 2013 assuming Congress upholds the legislation and barring no significant changes to the political landscape in the November 2012 elections.

How Much Is The Obamacare Investment Tax?

In a nutshell, certain investment and income taxes will increase by 3.8% from their current levels assuming no other legislative changes or expiration of current tax rates. Capital gains for high earners will jump from 15% to 18.8% on long term holdings.

In addition, there are also changes to the payroll tax. What once was a flat tax is now a means adjusted, progressive tax that will raise the Medicare payroll tax for joint filers with income above $250k and singles above $200k.

The Medicare tax will increase 0.9% to 2.35% from the current 1.45% on wages and self employment income. The Medicare tax is uncapped, so this new tax will apply to all income and wages above the aforementioned thresholds. High earning self employed persons will pay this amount twice.

What Investments Are Subject To The Health Care Tax?

Most tax experts believe that ordinary dividends and income, interest income, short and long term capital gains, rents, royalties, taxable annuity income, sales of primary residences above the $250,000/$500,000 exclusion, gains from sales on second homes and passive income will all be counted and subjected to the 3.8% surtax.

That is to say that almost all investments, save for a few, will now be subjected to these higher rates. Primary residence sales that result in large capital gains will not avoid this new tax. Joint filers are afforded a $500,000 exemption on the sale of a primary residence and single filers are allowed $250,000.

However a couple with $200,000 in adjusted gross income who has a $100,000 capital gain above the $500,000 primary residence exclusion amount would have to pay an additional 3.8% on the extra $50,000 above the joint $250,000 limit. Income and capital gains tax are combined and not mutually exclusive.

Investment properties and second homes are offered no exclusion upon sale and capital gains above the $250k joint and $200k single amounts would be subject to the 3.8% tax increase. This can be problematic for those with significant real estate holdings, but read on.

How Can I Avoid Or Reduce The New Investment Tax?

For those who are selling investment properties and residences that will result in significant capital gains, one such strategy may be a structured sale. With a structured sale annuity, the owner can defer constructive receipt of the capital gains and defer them over several years.

At present, structured sales have been accepted by the I.R.S when setup and executed properly by qualified tax professionals along side annuity insurance agents. By taking payments over several years, the capital gains can be spread out and in many cases help to keep investors below the new tax thresholds.

What About Other Tax Deferred Insurance Products?

When considering investments with tax advantages, there are two insurance products that can be helpful for many investors.

When considering investments with tax advantages, there are two insurance products that can be helpful for many investors.

The first is a simple and straightforward investment account known as a tax deferred annuity.

When compared to bank certificates of deposit, mutual funds, and dividend paying stocks (among others), a non-qualified tax deferred annuity can shelter income for the life of the owner. There are no forced distributions with a non-qualified annuity and the deferred income tax can be spread out over several years during the owner’s lifetime or amongst the annuity beneficiaries at settlement.

Perhaps even a better investment is life insurance. Life insurance policies grow tax deferred, but in contrast to an annuity, the proceeds are payable income tax free to the named beneficiaries. There is really no better investment when it comes to wealth transfer than a whole or universal life insurance policy.

What About A Roth IRA Conversion?

Converting your traditional IRA to a Roth IRA can be beneficial when done properly. Considering that time is running out in 2012 before the new investment tax takes hold, now is a good time to consider a Roth IRA conversion.

It goes without saying that you would want to speak with your tax advisor before converting any qualified account, but it should be noted that distributions from a Roth IRA are considered income tax free by the I.R.S. and thus would not be counted towards your adjusted gross income.

Those with sizable IRA accounts might consider a total or partial Roth IRA conversion now in order to potentially reduce taxable required minimum distributions at age 70 1/2 and beyond.

Contact Us To Discuss Tax Avoidance Strategies

Hyers and Associates Inc. is a full service, independent life and annuity insurance agency. We specialize in wealth transfer and tax avoidance strategies for those in higher income tax brackets.

Category: Articles, Health Care Reform, Wealth Transfer

Asset based long term care is quickly growing in popularity as those nearing retirement plan for potential long term care costs. There are only a few companies marketing long term care annuity policies and Mutual of Omaha is one of them.

Asset based long term care is quickly growing in popularity as those nearing retirement plan for potential long term care costs. There are only a few companies marketing long term care annuity policies and Mutual of Omaha is one of them.

Their policy is called the Living Care Annuity. The primary advantages of their hybrid annuity plans are the absence of ongoing premiums and the leverage gained on your invested dollars.

What Is A Long Term Care Annuity?

Simply put, a hybrid long term care annuity policy is an ordinary deferred fixed annuity with a declared fixed interest rate. The account grows every year through compounding interest. Assuming no interest is withdrawn, the interest gains will accumulate tax deferred.

The difference with a hybrid annuity is in the leverage it provides for long term care costs. The Mutual of Omaha annuity will leverage the invested dollars three times over for nursing home, assisted living, adult day care, home health care and several other LTC types of expenses.

Mutual Of Omaha Living Care Annuity Example

Let’s take the hypothetical example of $100,000 invested in a hybrid annuity. The $100k would grow each year based on the declared interest rate and would otherwise function like a traditional fixed annuity while in deferral.

However, the $100k would create a $300,000 pool of of money that can be accessed by the owner for LTC expenses two years after the policy has been purchased. The $300k pool of money would then be available over a minimum of 6 years for a total of approximately $50k per year – plus the interest growth.

If the annuity policy was accessed for long term care, the owner would essentially spend his or her own money for the first two years and for the next four years, s/he would be using the insurance company’s funds. That is to say, that after the policy has been spent down to $1 in value, Mutual of Omaha then pays the claims up to the individual policy limits.