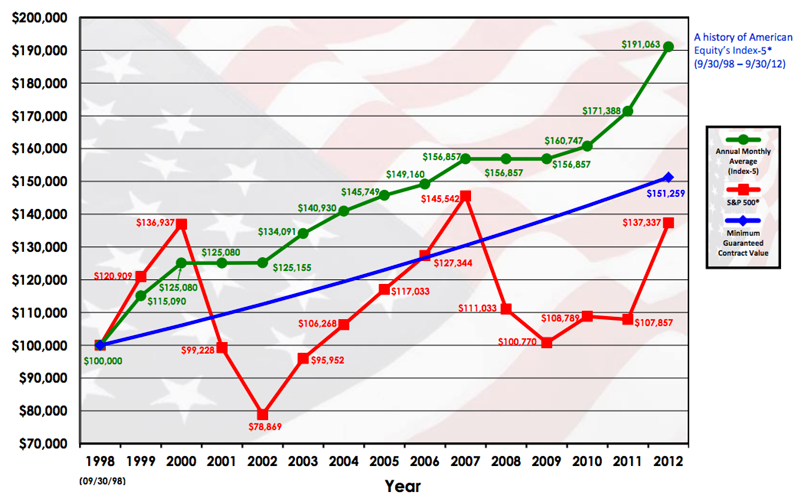

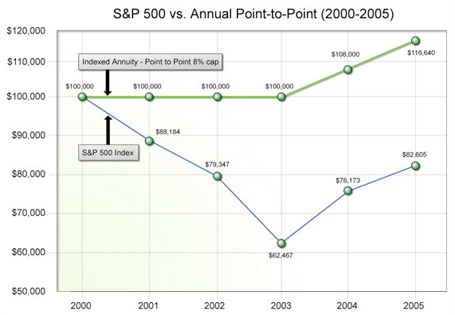

The charts below illustrate past fixed-indexed annuity returns from some of the more common indexed sub-accounts offered by insurance companies. These examples provide some context as to what kind of returns indexed annuity owners might expect.

It is important to understand that these charts only illustrate a few common accounts. If you are researching indexed annuities, you know there are several different indexing strategies to choose from. The ones you choose and when you invest will go a long way in determining your overall future returns.